“… long, sorry decline has left the 140-year-old company a shell of its former self. Today, it is fighting for its very survival. Western Union fell victim to technological advances…”

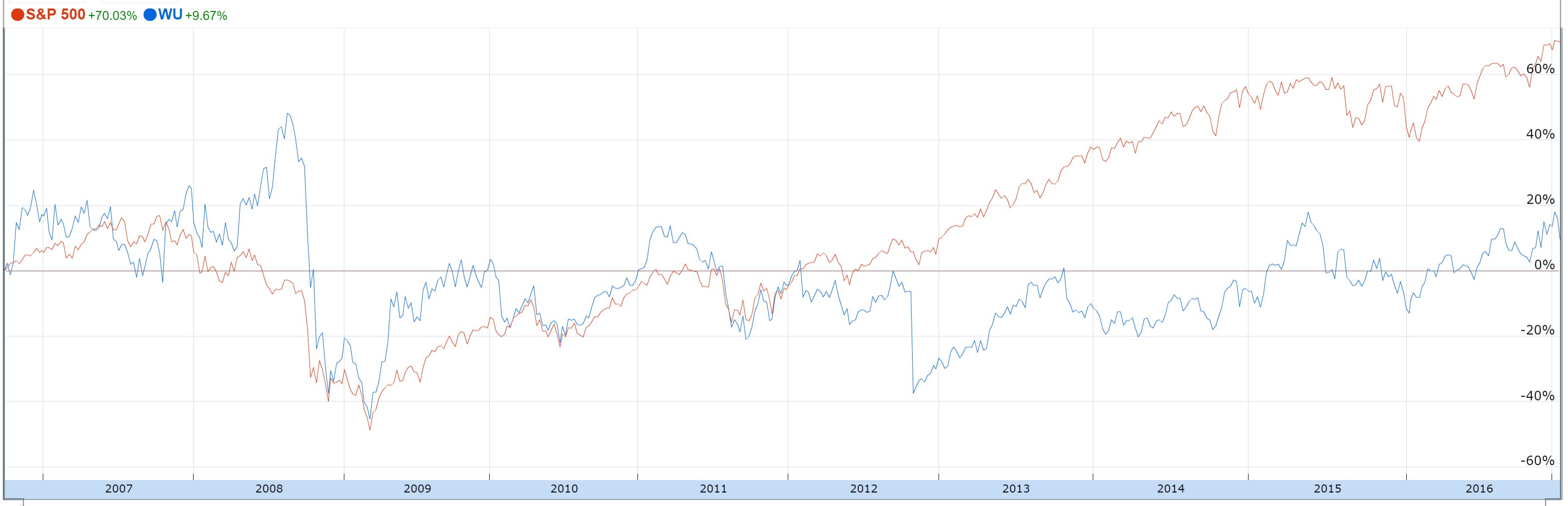

Reading current reporting about Western Union’s role in international remittances could make us think that the company has been a successful monopoly of this space forever, but, now, with the arrival of some disruptive innovation (“P2P”, “Bitcoin-blockchain”, “Social”, “Mobile”…), there is a real danger of its imminent demise. In reality, Western Union’s subsidiary, Western Union Financial Services Inc., began providing international money transfers in mid 80s when deregulation allowed a previously domestic service to expand internationally. By mid 90s, Western Union’s coverage included major remittance destinations like China. In those first ten years of its money transfer business, Western Union’s parent (renamed into New Valley in 1991) had plenty of upheavals going near or into a bankruptcy. After changing hands few times, the money transfer subsidiary was resurrected as an independent entity in 2006. Western Union’s stock performance has been highly volatile ever since with 20% decline in price since IPO, dwarfed by the overall market:

After faster initial growth, for the last three years Western Union’s business metrics have been flat. Reinvention requires a change in culture which won’t happen with existing management. Hence, with global growth in remittances slowing down, don’t expect a different picture in years to come:

That management rigidity was demonstrated in FTC’s lawsuit which Western Union settled in January 2017.

“Even though Western Union’s internal reports have identified agent locations where 5% to over 75% of the transactions constituted confirmed and potential fraud, and/or suspicious activities, Western Union has allowed many of these agents and subagents to continue operating, with only temporary suspensions, if any…”

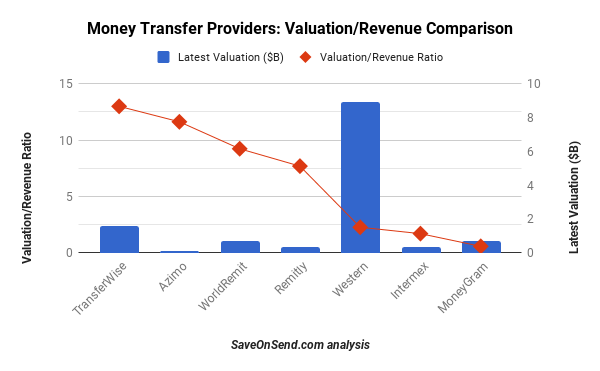

But Western Union is still valued at around $9-10 billion, and a “slow decline” story doesn’t seem to be interesting enough for most of publications. Instead, we are being subjected to sensational reporting about Western Union’s being on the way to oblivion due to, again, some innovation du jour – this time, instead of “fax machine” or “Internet” from 20-30 years ago, it is Facebook or Bitcoin or FinTech startups.

The reasons for such sloppy reporting across Tech media, Wall Street Journal, New York Times, and other publications are laziness and overconfidence plus host of cognitive biases. For example, it could be due to a powerful “projection bias” which makes us assume that everybody is similar to us or want to be similar to us. So if a reporter is eager to try sending money with mobile, Bitcoin, Facebook, then frequent senders of remittances shall be also very interested in such transfer method.

1. Western Union’s Market Share

As with most facts about international consumer remittances, Western Union’s market share presents a complex picture – over the last decade, it has declined slightly while the company cross-border transfer volume has been growing till 2014:

The market share decline till 2014 is due to a much faster increase in global transfer volumes over the same period. In 2015 and 2016 both global remittances and Western Union transfer volumes declined at a similar pace keeping the company’s market share unchanged. To make matters more complicated, the data on global transfer volumes is very hard to obtain. For directionally accurate information, The World Bank provides uniquely valuable resources; alternatively, for in-depth analysis of specific corridors one could hire an industry expert like Faisal Khan.

The remainder of the remittances market is highly fragmented, with dozens if not hundreds of providers of various sizes competing in each large corridor. Obviously, Western Union’s market share is also not evenly distributed across global corridors. For example, in the world’s largest corridor for remittances, USA-to-Mexico, Western Union’s market share is closer to 20% but is slowly declining:

Source: http://secfilings.nasdaq.com/filingFrameset.asp?FilingID=12437951&RcvdDate=12/20/2017&CoName=FINTECH%20ACQUISITION%20CORP.%20II&FormType=8-K&View=html

There are top corridors where its share is less than 10%, and there are very small corridors where it is approaching 50%. But, as we wouldn’t call a single gas station in a small town a “monopoly,” it seems odd to criticize Western Union for providing services in places where nobody else wants to compete.

2. Western Union’s track record of innovation

Many ardent fans of Bitcoin and FinTech startups love a story about Western Union’s rejection of “talking telegraph” in 1876, but seem to forget that Western Union had maintained a telegraph monopoly for the next 100 years launching many innovations in the process.

While PayPal was first with email transfers in 1999, in its more recent money transfer history, Western Union went first online in 2000, started singing up mobile partnerships in 2007, launched a smartphone application in 2011 when TransferWise and Remitly were just starting and before Azimo was founded. While TransferWise is known for innovative use of data for driving referral traffic and Remitly has positioned itself as a “mobile” innovator, Western Union has been leveraging the latest technologies in a more comprehensive way. Whether its extensive use of “big data”, exploring partnership with Ripple Labs, or investing in blockchain, the popular narrative about Western Union as backward and ignorant is not supported by facts:

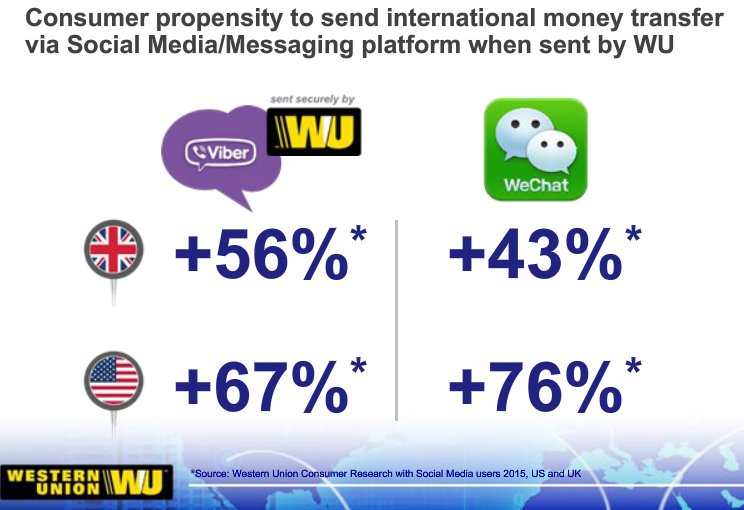

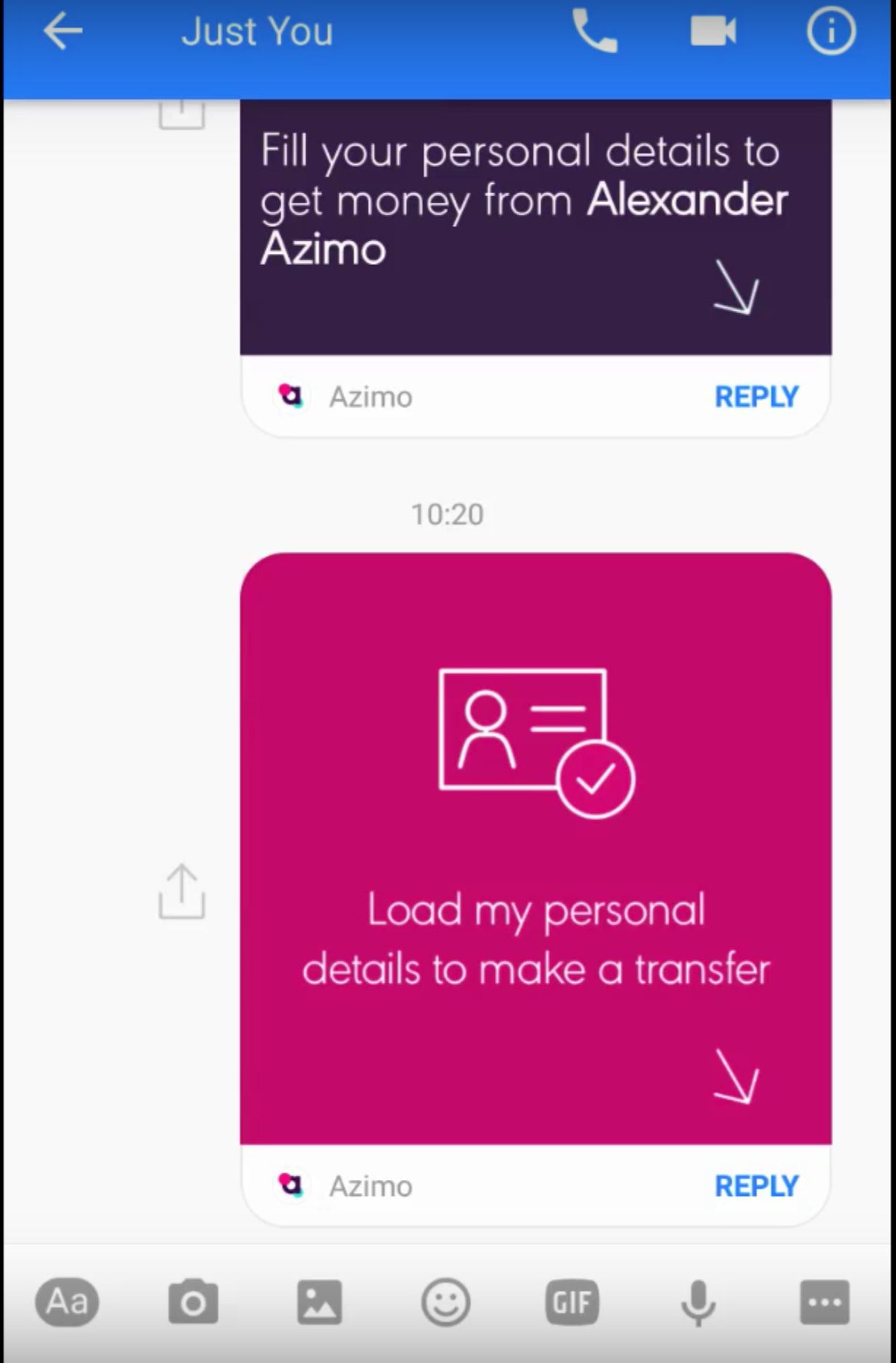

Western Union was also the first to launch partnerships with WeChat and Viber. Why would such innovative providers partner with Western Union? Technically, because Western Union could execute such complex integration better than anybody, but primary reasons is that consumers trust Western Union much more when it comes to money transfers:

Western Union was already larger than Xoom prior to establishing a dedicated online-mobile unit, Digital Ventures, in San Francisco in 2011. Since then, the company has been growing its digital business 20-30% annually:

… and with no other provider close in sight except TransferWise which is growing faster in absolute terms as of late 2017:

It is also important to keep in mind that 80% of new WU.com customers are net new, i.e., they haven’t used Western Union in any capacity before. It means that there is relatively little cannibalization, around 2%, from Western Union’s offline to digital channels – instead, the company is managing to attract entirely new customer segments. There is a myth fueled by Fintech PR that younger consumers prefer new providers. Looking at actual demographics segmentation of customer base for incumbents across financial services, one would find that so-called “millennials” have a similar preference for trusted brands (aka “incumbents”) as other generations:

Western Union has accomplished a similarly strong growth in the online engagement across key social sites, coming up with an innovative idea to develop dedicated Facebook pages for Filipino, Indian, and Latino customers. As a result, its engagement metrics are 10x higher than of its main online competitors.

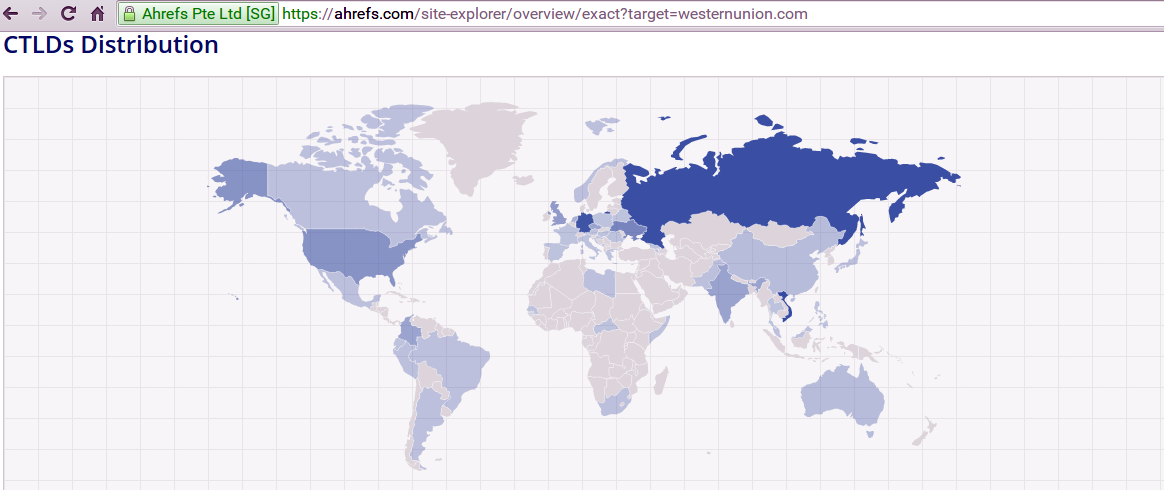

However, at SaveOnSend, we are skeptical of any online engagement metrics. In case of Western Union, like with many other remittance providers, users from Russia seem to be significantly more proactive than the ones from the US which is somewhat unexpected:

Western Union’s on-going digital transformation is not just focused on a customer engagement. Over 2016-2017, the company is spending $120 million on “WU Way,” an efficiency program, mostly on severance (40% of all costs) and consultants (25% of all costs) with an objective to digitize its operations, consolidate 55 off-shore IT locations, and lay-off material portion of staff, hoping to realize $20-25 million in annual savings.

Hence, Western Union’s performance in digital is hard to interpret. Despite solid growth, it fell far short from its own expectations in 2012 to reach $500+MM in Digital revenue by 2015. Western Union’s USA website is still only available in English and Spanish, and its outbound digital services are available in around 20% of countries (41 as of August 2017):

After on-boarding 20 countries by 2010, and 23 in 2011, Western Union added only 2 countries to its digital footprint in 2012-2014, but then added 9 in 2015. It is now covering 90+% of the world outbound send countries by transfer volume, and remaining ones are either too small or are constrained by government regulations that prohibit online remittances. When UAE, among top-10 countries in outbound remittance volumes, decides to allow digital money transfers, there is little doubt that Western Union’s effort in securing its digital market share there would be immediate and massive. 70+% of Western Union customers have bank accounts, but only 10% of consumer revenue comes from digital channels, and it is not because the company doesn’t have the right digital offering. The usage of digital channel varies dramatically by corridor or, to be more precise, by ethnicity. As we discuss later, there are many fundamental differences among Indians, Filipinos, Chinese, Mexicans and other major migrant groups living in USA. One such difference is a ratio of disclosed income. For Indians, who happened to be mostly in white-collar jobs, that ratio is very high. But many other nationalities get paid in cash and avoid taxes (think of your typical babysitter, a gardener, or a cab driver). Using digital channels is not a consideration for those groups because while saving few dollars they have a much more significant concern about being reported to IRS.

Such prioritization across corridors also makes sense in the offline word. Western Union’s agent network went from 200K agents in 2006 to 485K in 2011. By 2017, that number only increased to 550,000. Why such slowdown in adding new agents? Because around 30% of those agents are already not seeing any remittances according to 2016 annual filing:

“As of December 31, 2016 , more than 70% of our locations had experienced money transfer activity in the previous 12 months”

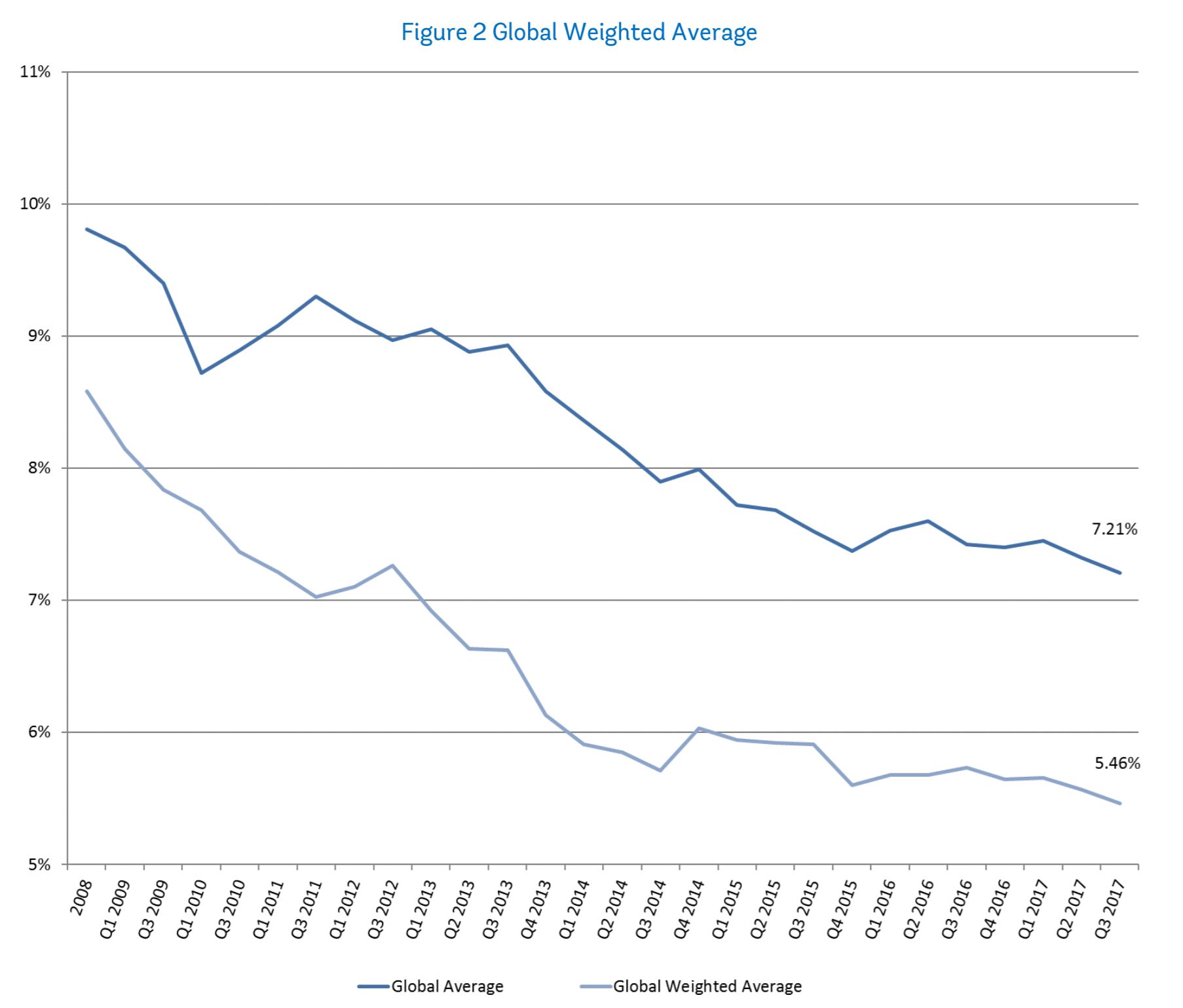

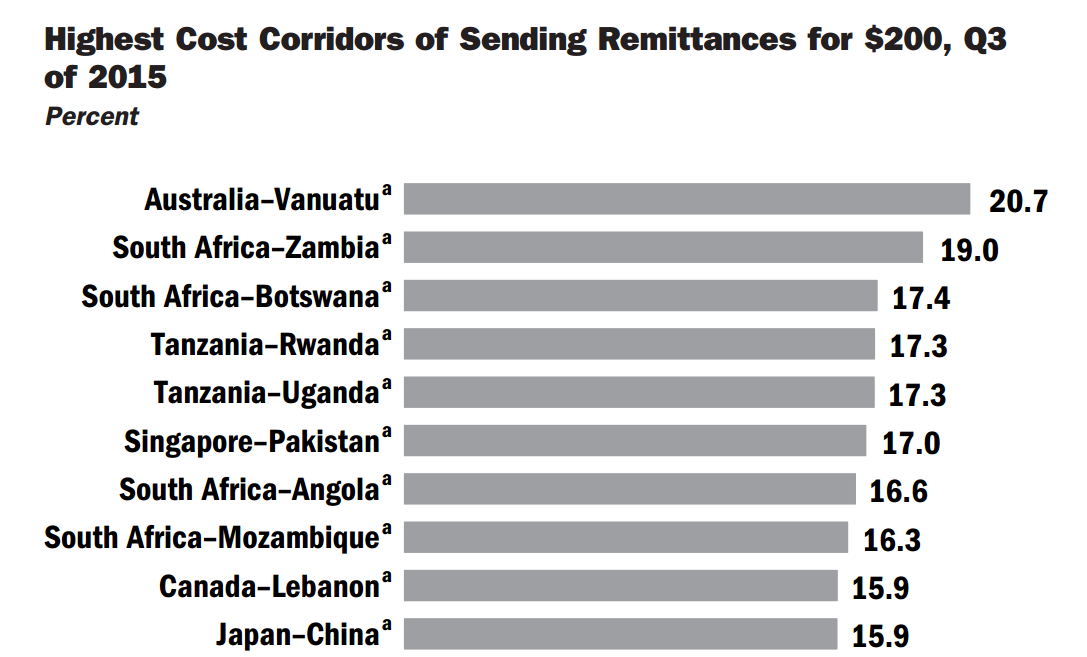

Western Union is not unique in its business-savvy prioritization of where to offer its services. For all their posturing about helping “poor” and “unbanked,” FinTech remittance startups continue setting up offices in the world’s wealthiest cities targeting well-off and tech-savvy senders while conveniently accusing Western Union of being a high-price monopoly. Here are the world’s most expensive corridors – check which startups are offering services for those:

Source: https://openknowledge.worldbank.org/bitstream/handle/10986/23743/9781464803192.pdf?sequence=3&isAllowed=y

Talk is cheap, but VCs could be very impatient, and selecting a smaller corridor with a small percentage of tech-savvy users is just not lucrative enough. Here is how Remitly’s founder explained his motivation when launching the startup in 2011 (read full story here):

Words like “kid”, “education”, and “Africa” must be a part of any pitch deck, and, apparently, the only practical way to send money from USA to Kenya in 2011 was to start another company. So which destination did Remitly start with? It must have been Kenya? Nope, too small volume – $0.5B per year, plus that kid didn’t seem to care for school anyway. Maybe it was Nigeria? At least it is in Africa and among Top-5 global destinations. Nope, still not big and tech-savvy enough… so Remitly started with Philippines and 3 years and $20MM+ in funding later continued with India, then with China and in 2016 with Latin America. Remitly also expanded into its outbound business beyond the US into Canada and UK, but… Africa just has to wait.

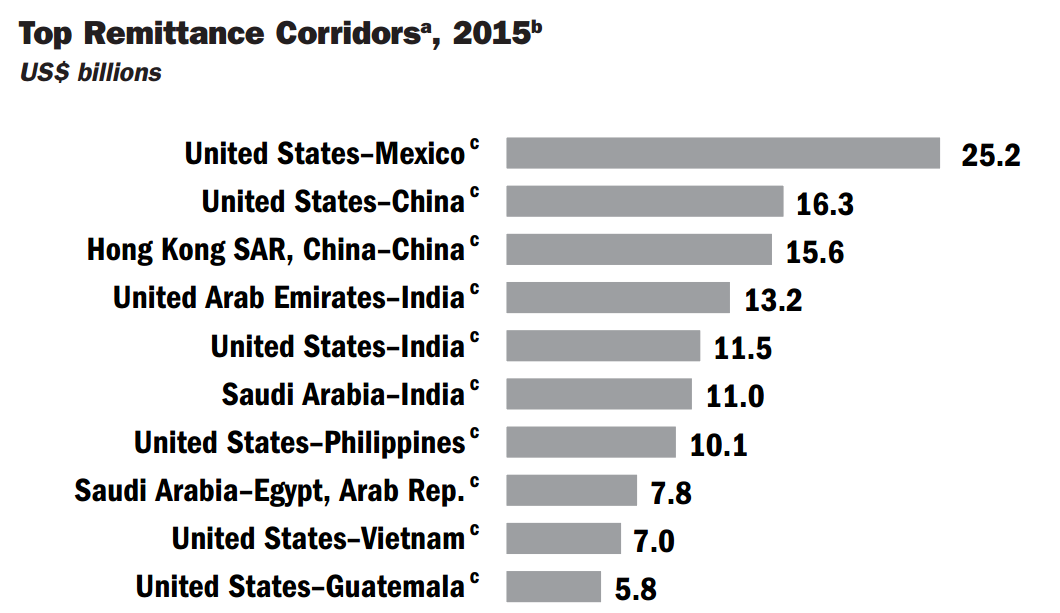

Why is this anecdote relevant to our question about Western Union’s leadership position? It is representative of a mindset common for remittance startups. Rather than challenging Western Union’s market share where it doesn’t have an online presence, they are going after the same “top” corridors where Western Union’s Digital Ventures is already well-established:

Source: https://openknowledge.worldbank.org/bitstream/handle/10986/23743/9781464803192.pdf?sequence=3&isAllowed=y

Instead of Lagos and Sao Paulo, they open regional offices in Denver and New York, coming to Western Union’s home turf where it has proven to take “full-measure” when warranted.

3. Western Union’s competitive zeal

Western Union strategy is both complex and assertive. While overall commanding 15% pricing premium for its brand, Western Union applies substantially different margins across corridors. It is frequently adjusting fees across transfer amounts and send-receive methods. While such practice is consumer-unfriendly, it shows that Western Union takes a considerable effort in order to maximize profits.

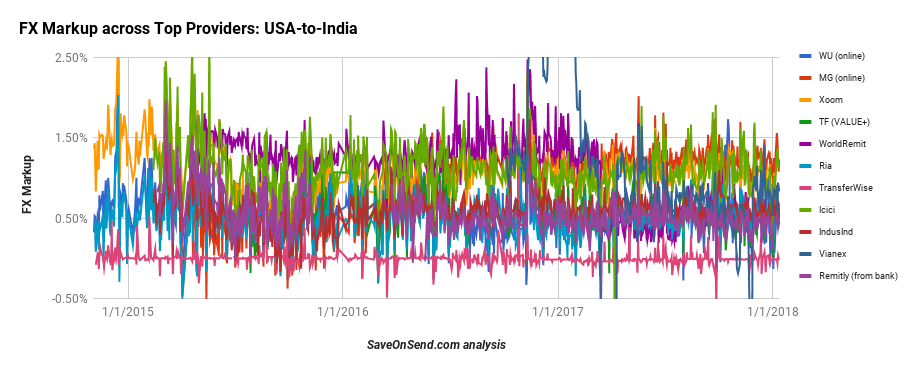

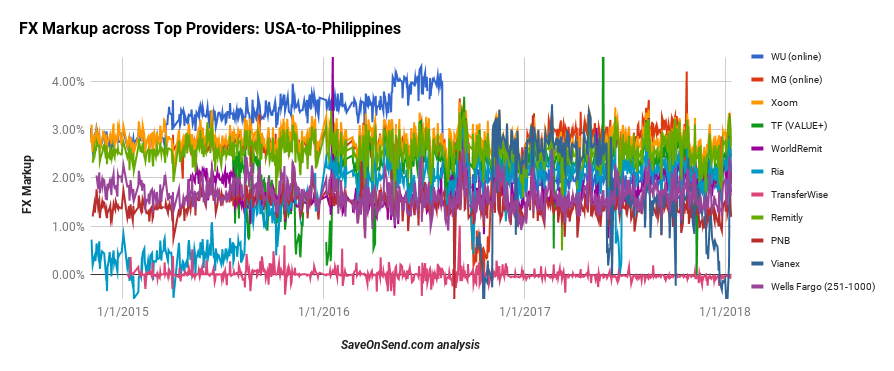

For example, Western Union’s FX markup for sending money from USA to India is one of the lowest, for USA to Philippines, till recently, it was one of the highest:

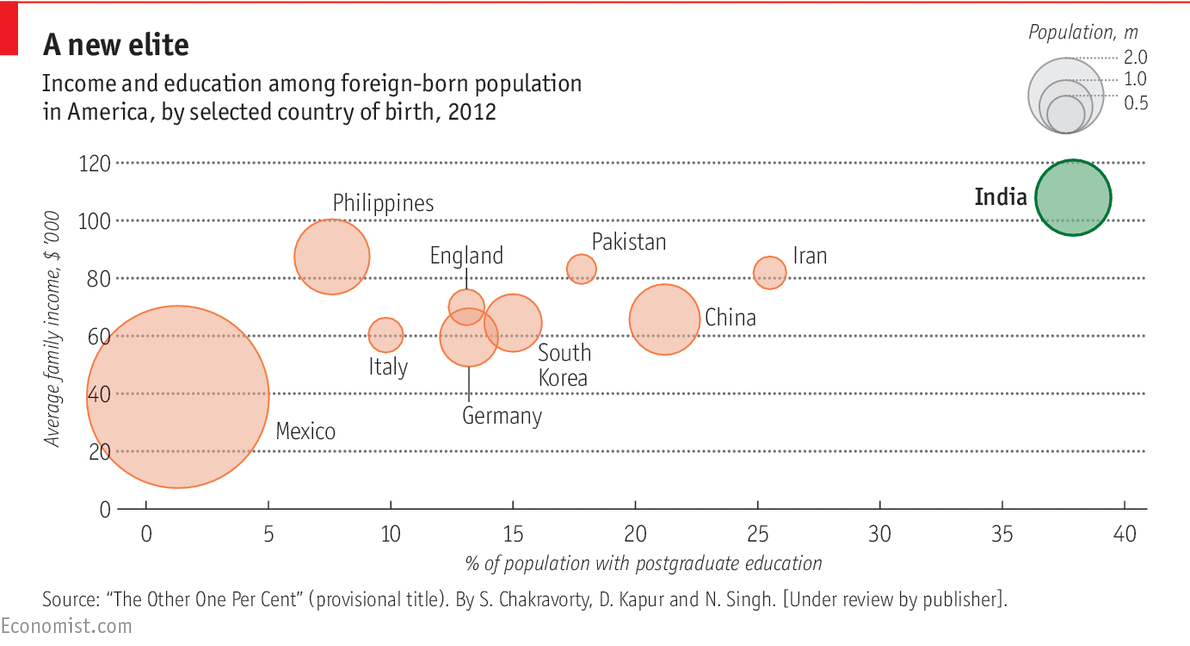

What could explain such difference in tactics for two corridors that are quite similar in size and located in the same region on a global scale? Let’s review how Indian and Filipino migrant groups living in USA are comparing in income and education:

Because Indians are so far ahead of other main migrant groups in education, they are quite unique in their engagement when it comes to remittances. More than 80% of money transfers by this group in USA are conducted online. From a cultural standpoint, Indians are significantly more likely to compare prices using sites like SaveOnSend, and are more likely to switch providers:

For other migrant groups, the average use of digital for money transfer is less than 10%, for Filipino senders from USA being slightly higher. Other migrant groups also seem to conduct less price comparison and seem to be less prone to switching providers. As a logical consequence, Western Union has to be and is far more competitive in the USA-to-India corridor. In a related example, after noticing TransferWise activity in UK, Western Union reduced margins and offered specials to ensure its market share. With Chinese customers, the issue has more to do with a culture of secrecy and mistrust of formal channels. So Western Union at times would be offering literally free transfers for some send-receive methods in order to gain a foothold in this segment:

“…We do have corridors, which is zero FX. We do have corridors, which are higher FX, zero fees. We do have corridors where there’s both are that. It’s really like an airline management where you fly from one destination to another destination, which seats you for use, and that’s exactly what we are doing with our teams. I think, in the portfolio management, the team is impressive. It’s really looking at every corridor, understanding the customer needs on FX side.”