“I think we will know when bitcoin has reached prime time when it is transferring more value each day than Western Union or Money Gram…”

Bitcoin money transfer is usually discussed in either sensational or downright misleading way. There is a significant category of Bitcoin or, currently more popular, blockchain stakeholders and observers who seem to be completely vested in this innovative product’s awesome potential and are unable to entertain a deviating opinion. This very smart and capable, but, unfortunately, close-minded group believes that Bitcoin cancels a need for regulation and would soon destroy Visa, Western Union and “banks.” Articles written for and by such audience are easy to find, and we will not link to them to avoid enabling such either outrageously ignorant or deceptive opinions.

Rational view of Bitcoin/Blockchain for sending money

In this context, we are always grateful to find discussion about Bitcoin/Blockchain for remittances which attempts to be more objective. Here are some examples: Bootstrappers guide to bitcoin remittances, Tackling bitcoin price swings OR

or

However, even more reasonable experts seem to be de-emphasizing a fundamental diversion in understanding of Bitcoin/Blockchain value that shall be considered for its potential in international money transfers. Here are the key points made by proponents, usually taken at face value.

Large segment of consumers is suffering without Bitcoin/Blockchain money transfer

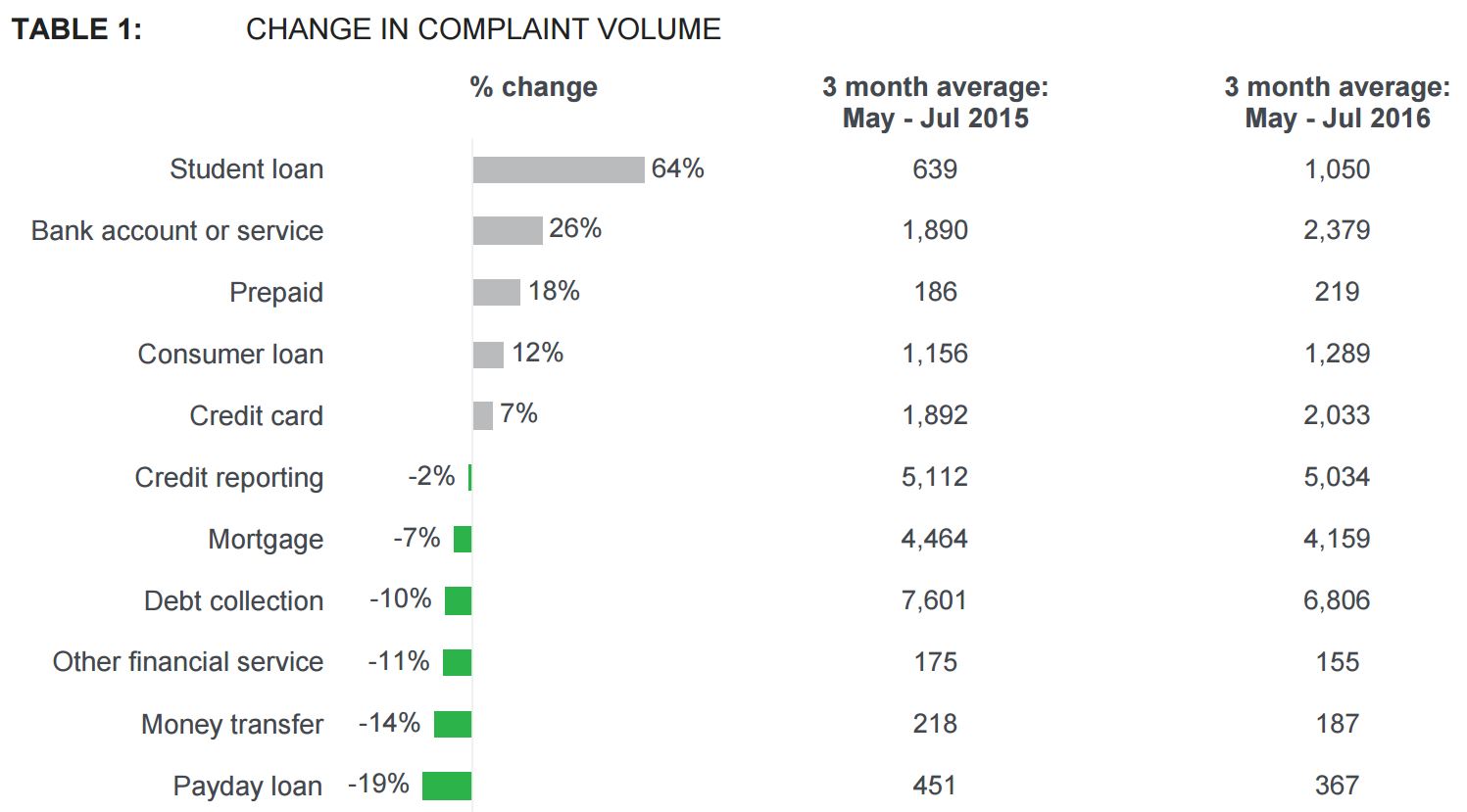

“The unexpected tragedy of the financial system” is quite representative in this regard. What is common about these articles is seemingly absolute lack of a field research or basic customer surveys. For example, there are monthly government reports that analyze consumer complaints about providers of financial services. Reading such report for the US market, there are relatively few complaints about money transfers and most of those are centered around fraud, not exactly a strong suit of Bitcoin with its embedded anonymity:

Source: http://www.consumerfinance.gov/data-research/research-reports/monthly-complaint-report-vol-14/

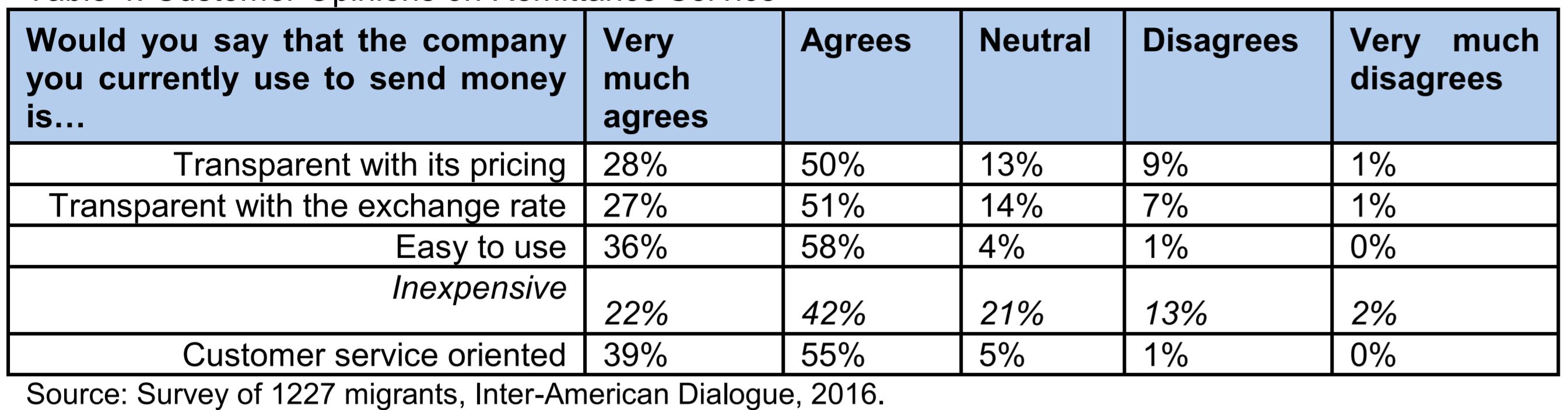

Speaking with enough low-income consumers who transfer money internationally, one could quickly discover that there is no “tragedy,” and, what is most puzzling, this segment is not even that eager to save on sending money:

Why? It is not because low-income senders are lacking infrastructure. A large portion of SaveOnSend’ “cash” users have a smartphone and a bank account which could be easily linked for an online money transfer. BUT they are sticking with a cash agent, and, as the result, are paying 3-5-10 times more for sending money home. Counterintuitive? Yes. Tragedy? No.

Why? It is not because low-income senders are lacking infrastructure. A large portion of SaveOnSend’ “cash” users have a smartphone and a bank account which could be easily linked for an online money transfer. BUT they are sticking with a cash agent, and, as the result, are paying 3-5-10 times more for sending money home. Counterintuitive? Yes. Tragedy? No.

And that is why, offline-to-online shift in remittances is happening at a crawling, 1-2% annually, pace and will be taking decades, not years. This is not unique to remittances. Such slow adoption is actually quite typical for other types of financial transactions: from cash to plastic cards, from checks to online billing, or from a “swipe-insert” plastic card to a “touch” payment with a phone or a watch.

Bitcoin/Blockchain money transfer can help the needy

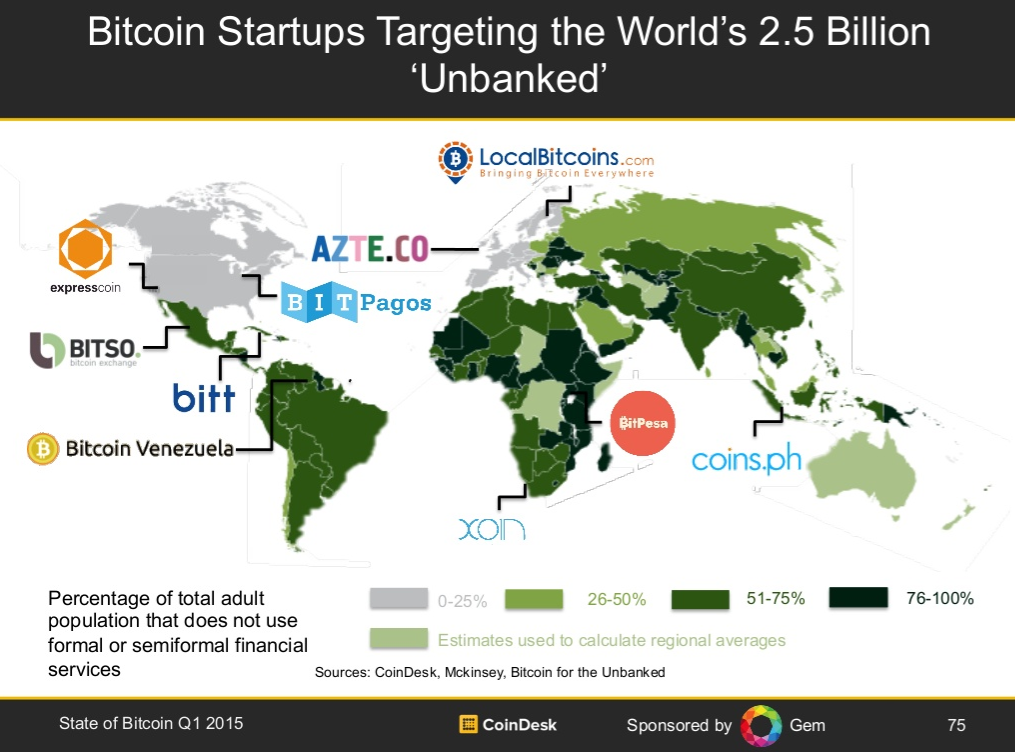

Articles about FinTech-Bitcoin-blockchain are often trying to invoke “unbanked” “poor” or “women” as the reason and special focus for money transfer startups. Instead of simply acknowledging that these startups are primarily founded to make money and accumulate market power, we are asked to believe in their higher calling. Not surprisingly, such articles are always missing two critical components which would make those claims believable: 1) specifics on targeting such segments, 2) explanation on how to make money with such targeting:

This argument is misinformed on both the sending and receiving ends of a money transfer transaction. By definition, most of the senders who transfer $200 per month to their families in India, China, Philippines, Mexico have money. Which means that majority of them have both a bank account (70+% for Western Union and same for MoneyGram) and a smart phone. For example, there were only 7% of Americans without access to banking services in 2015. 69% of migrants in US had access to banking in 2016, more than doubling from 30% in 2005:

On the receiving end of remittances, being unbanked is not a significant inconvenience or cost issue. With around 550,000 Western Union’s agent locations, money could be easily picked up by the great majority of such unbanked recipients (30% of those locations see NO remittance activity). There will always be pockets of consumers who live in extremely remote areas, but reaching them with an advanced technology in a cost effective way is simply unrealistic at this point (more on that later).

On the receiving end of remittances, being unbanked is not a significant inconvenience or cost issue. With around 550,000 Western Union’s agent locations, money could be easily picked up by the great majority of such unbanked recipients (30% of those locations see NO remittance activity). There will always be pockets of consumers who live in extremely remote areas, but reaching them with an advanced technology in a cost effective way is simply unrealistic at this point (more on that later).

There is virtually no advantage between receiving money into a bank account vs. picking them up from a cash agent – in most cases, a provider’s margins are the same for either method (check for yourself with SaveOnSend app). Moreover, one of the top reasons for migrants’ use of informal channels is tax avoidance (read this research). Bitcoin provider could address such concern by promoting Blockchain’s anonymity, but no established startup might be willing to take on such risk (more on that later).

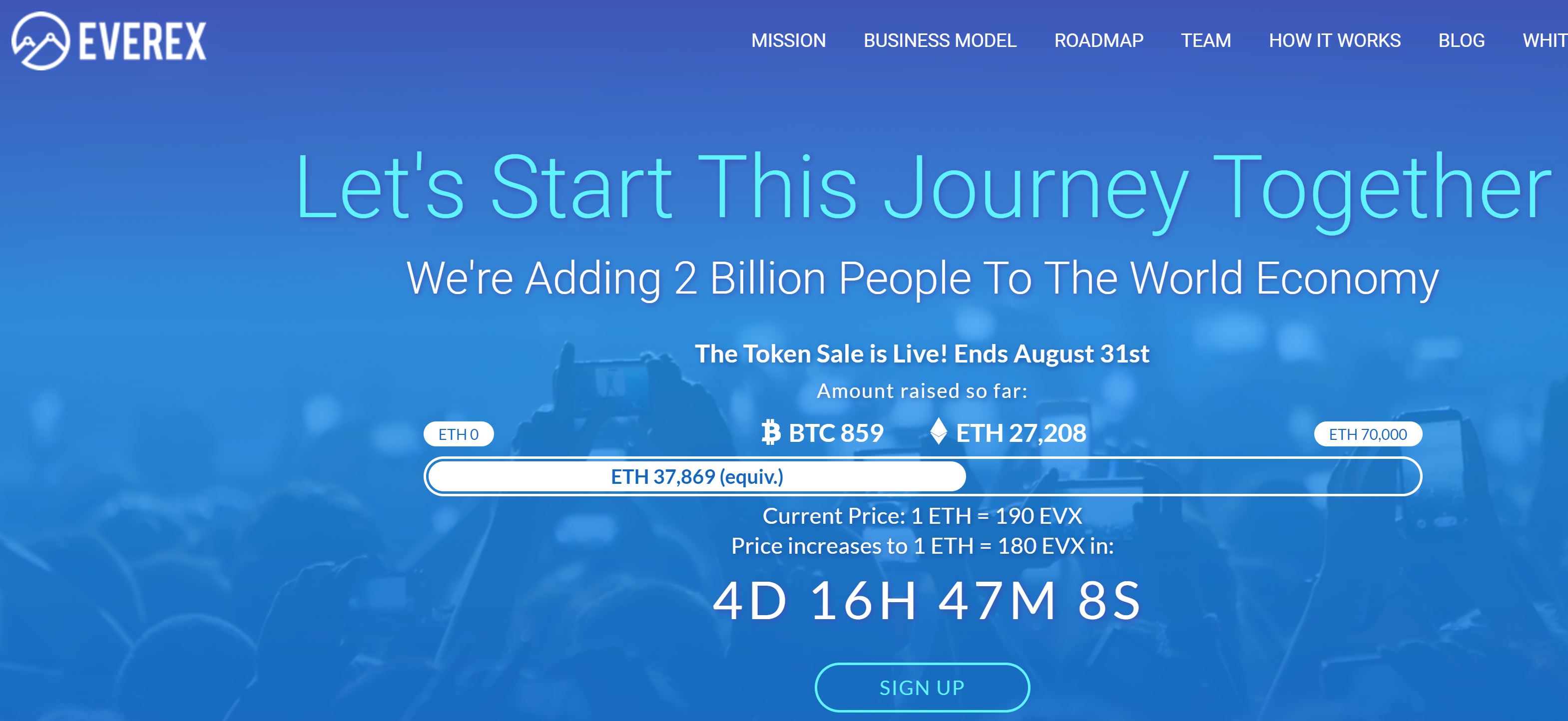

Many of the original Bitcoin remittances startups were founded before 2015 by people without a cross-border expertise who did not know these facts and had a sincere hope to help unbanked with remittances. Founders of recently launched Blockchain-based startups came from the industry, and such information became a common knowledge… but new Blockchain startups keep repeating the same message of helping “2 billion unbanked” while targeting digitally savvy and better-off consumers:

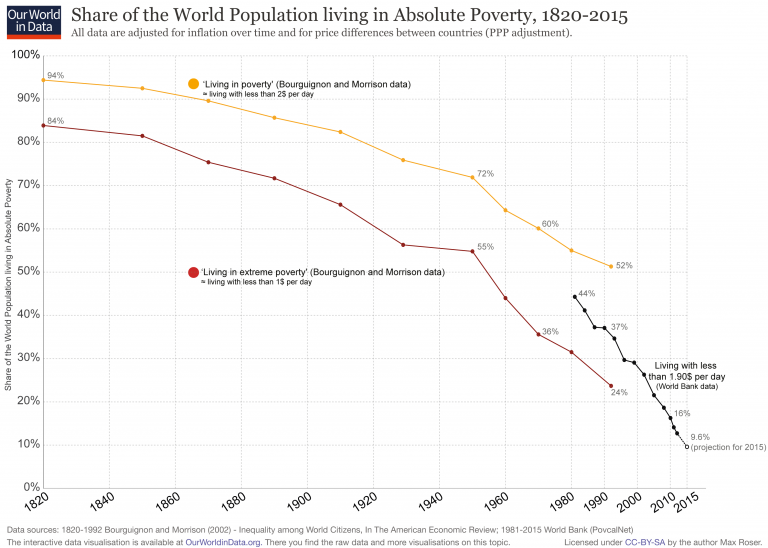

And what about those poor-unbanked-women that Fintech stakeholders talk about so much? They will be just fine. Even if Fintech, Bitcoin, Blockchain, Mobile Money, Big Data or all digital innovations combined disappear tomorrow, the old technology has been sufficient in eliminating poverty:

Bitcoin/Blockchain money transfer is instant and, thus, doesn’t carry the FX volatility

The “nearly-instant-free” transfer via Bitcoin was true to some extent up until the middle of 2015, but the Bitcoin community has been unable to solve a technical problem which led to systematic transfer delays and higher fees (see details here). Regular cross-border money transfer is already evolving to a real-time payment. For example, in the world’s largest corridor, USA-to-Mexico, many providers already deliver funds in a day or less and more will join (check for yourself with SaveOnSend app):

Comparison of Providers – USA to Mexico, $500 transfer, bank-to-bank linked accounts, March 22, 2018

Money transmitters like Xoom or TransFast could already send money virtually instantly for 70-90% of bank-funded transfers. They have developed a better risk management and bank connectivity, and other providers will eventually catch up. With other providers, consumers could get an instant transfers if they are is willing to pay a bit more for using a debit card. Why does a bank transfer takes days while a debit card is instant? Because instead of using a private rail of Visa and MasterCard, banks had to rely on outdated government networks which could take few days to confirm a transfer. But not for long. Australia, UK and few other countries already implemented near-real-time payments capability. Similar implementations in other countries, such as USA and Canada, are already under way, with most developed countries expecting to launch near-real-time rails by 2020.

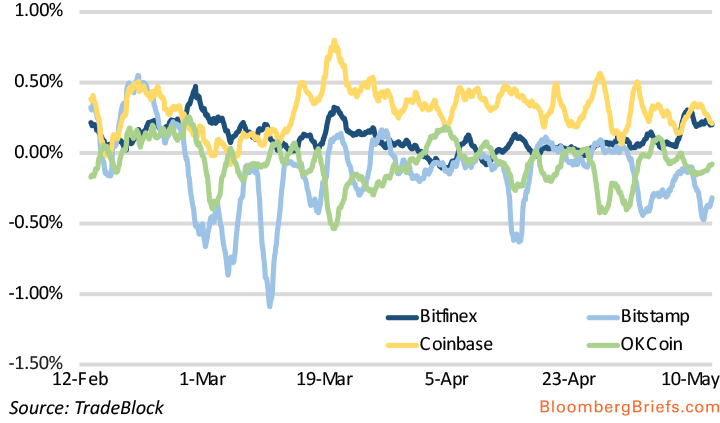

So any speed advantage of Bitcoin-blockchain is being eliminated, plus a transfer via Bitcoin-blockchain carries an FX conversion disadvantage, a double-whammy:

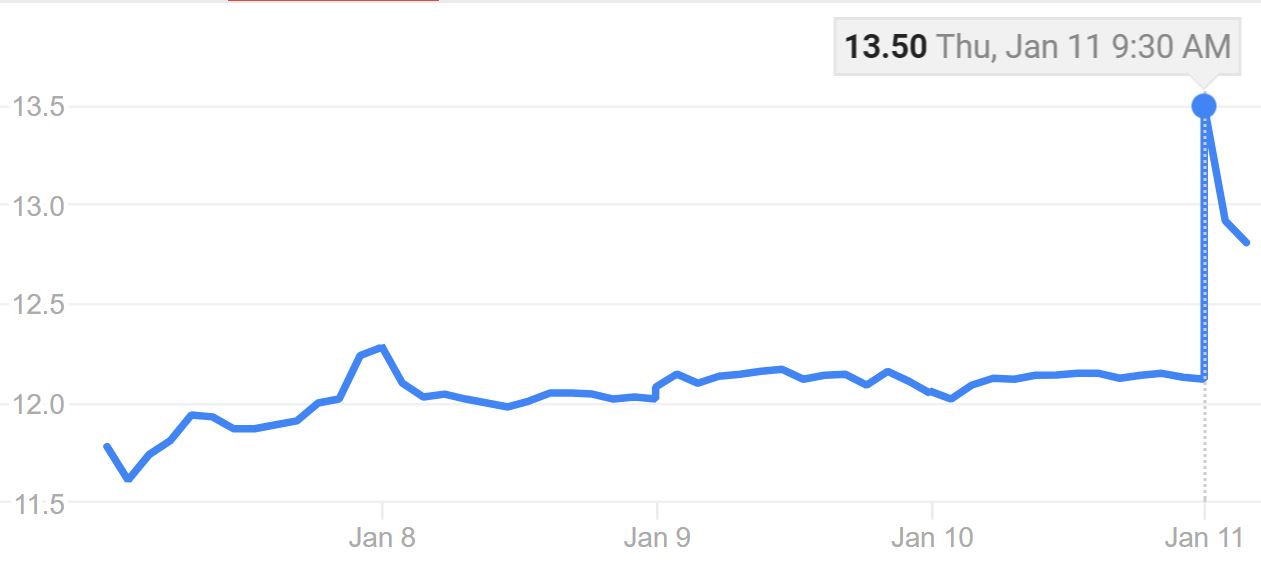

– since Bitcoin is more volatile than pretty much any other currency, its internal spread is higher (see the chart below for 2015), and so is its spread for each conversion

– Bitcoin needs to be converted extra time or sometime even twice. For example, for sending money from USA to Mexico, it needs to be converted an additional time (USD-MXN vs. USD-BTC-MXN). For an USD-to-USD conversion when sending money from USA to countries with an option of multiple receiving currencies, like China or Philippines, Bitcoin needs to be converted twice vs. zero times with regular remittance providers.

Here is how HelloBit’s co-founder and CEO Ali Goss summarizes this conundrum in the insightful article by Bitcoin Magazine:

“With bitcoin, you’re adding a third currency,” Goss said. “You go from U.S. dollar to bitcoin, and then from bitcoin to whatever the local currency is. You’re adding an extra FX move right there alone. That increases friction. On top of that, small startups don’t have a big FX department, and they don’t have the big abilities that come with such a department … they’re generating more costs for themselves, not less.”

Bitcoin’s key FX challenge remains an insufficient liquidity in many corridors. The spreads are so high that even die-hard Bitcoin players are using non-blockchain rails to complete transfers for those destinations. Yeap, you heard this right, EVERY so-called Bitcoin/blockchain money transfer startup pays banks to process a large portion, sometime a majority, of its cross-border transfers. Here is ZipZap in this interview to CoinDesk:

“ZipZap uses a combination of traditional (Swift) bank payment rails and blockchain technologies to find the least expensive and most efficient transfer option…”

Bitcoin can dramatically reduce remittance prices

Most of the potential savings for international money transfers could be realized today, immediately, IF ONLY senders stop going to cash agents and spend 3 minutes linking their bank accounts on their smart phones using their existing providers like Western Union or Ria Money Transfer. Not understanding why so many senders continue spending 3-5-10 times more while having a bank account and a smartphone will likely lead to many disappointments for Bitcoin money transfer startups and their investors down the road (read our analysis of fundamental difference in behavior of senders from USA to India vs. Mexico).

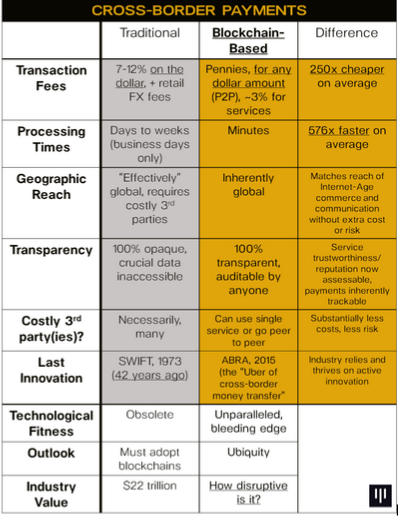

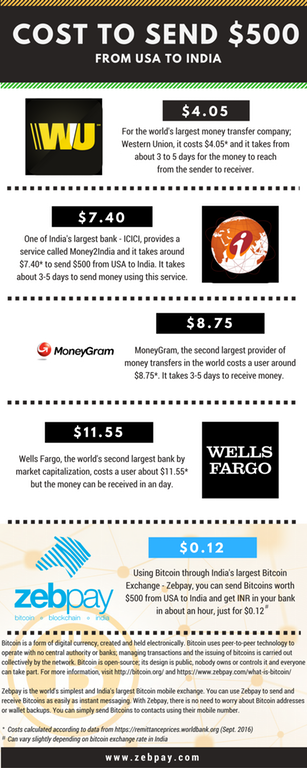

Examples of such disappointments are frequent – see the “Graveyard” section toward the end of this article or read these insights from Bitcoin entrepreneurs. But still too many Bitcoin remittance stakeholders keep repeating an outdated adage of a 10% average margin by “traditional” providers and that Bitcoin solution is 250x cheaper:

Same notion is prevalent among Fintech experts. Here is Chris Skinner on a Breaking Banks podcast (starts at 32:45):

“Now using companies like Abra a US citizen could send someone in Philippines a hundred dollars with hardly any commission taken off, compared to 25% or more being taken by traditional players.”

Instead, spend 30 seconds on SaveOnSend app to find the actual commission for sending different amounts…

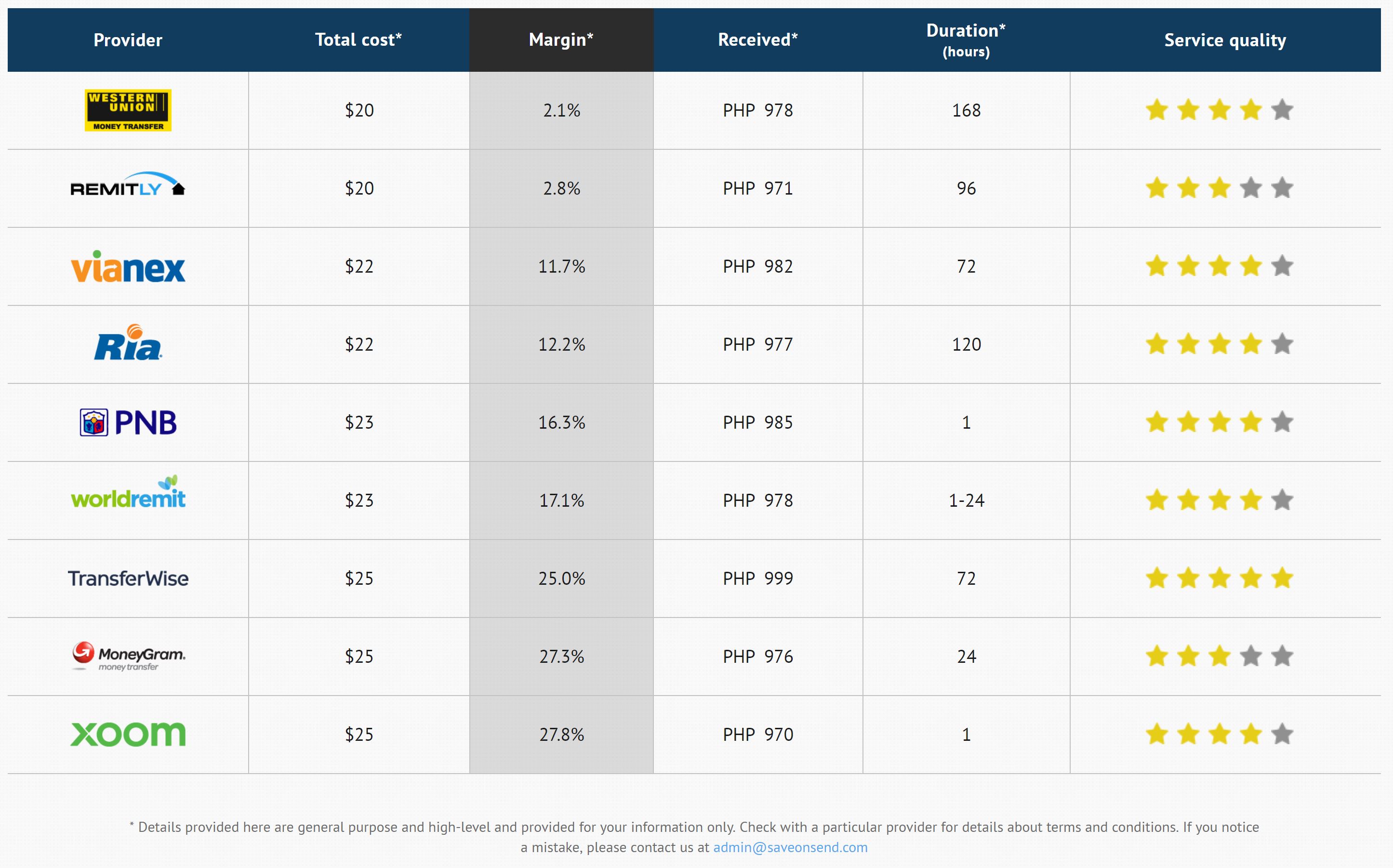

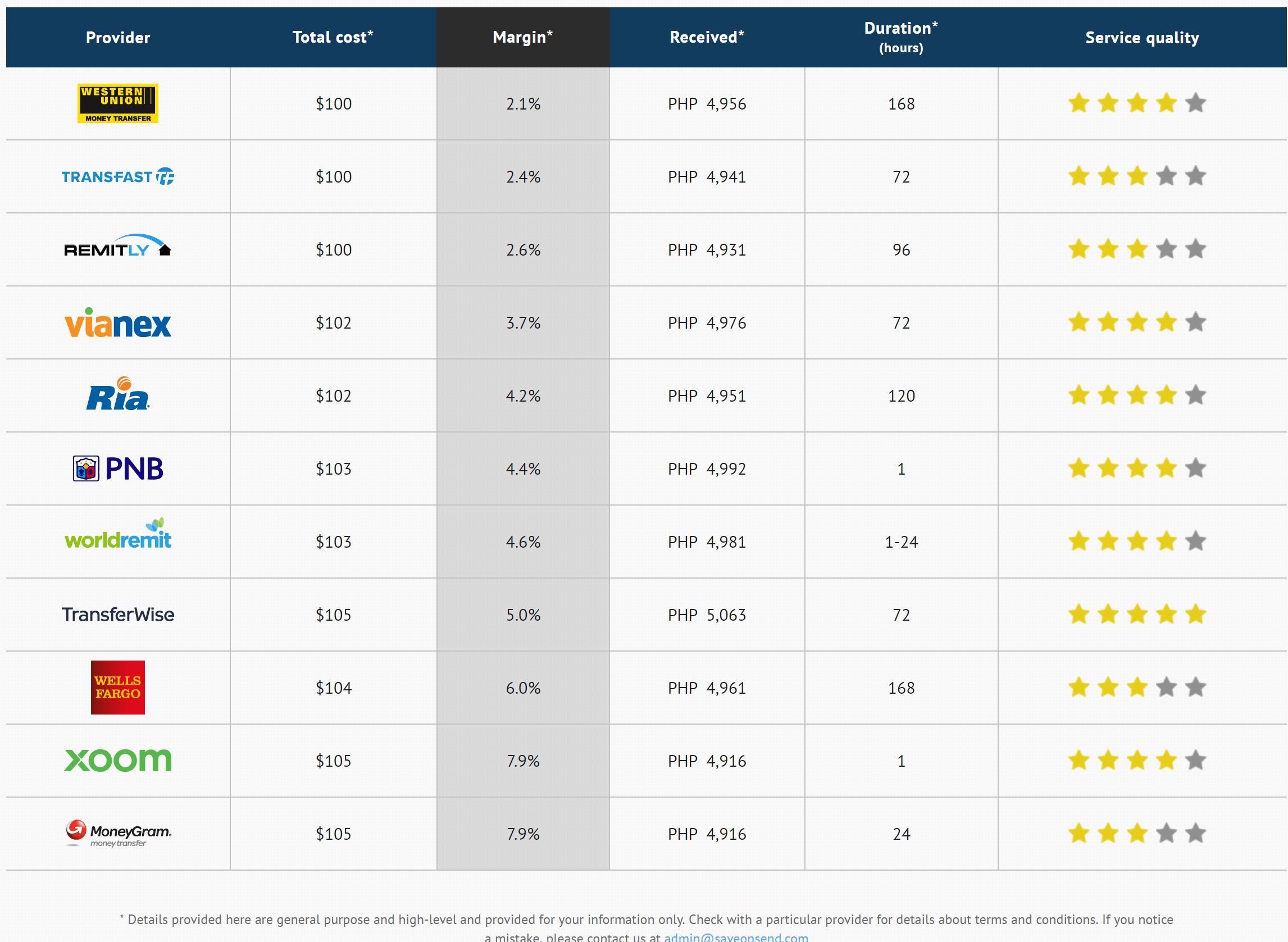

Comparison of Providers: money transfer USA-to-Philippines, sending $100, bank-to-bank, July 15, 2017

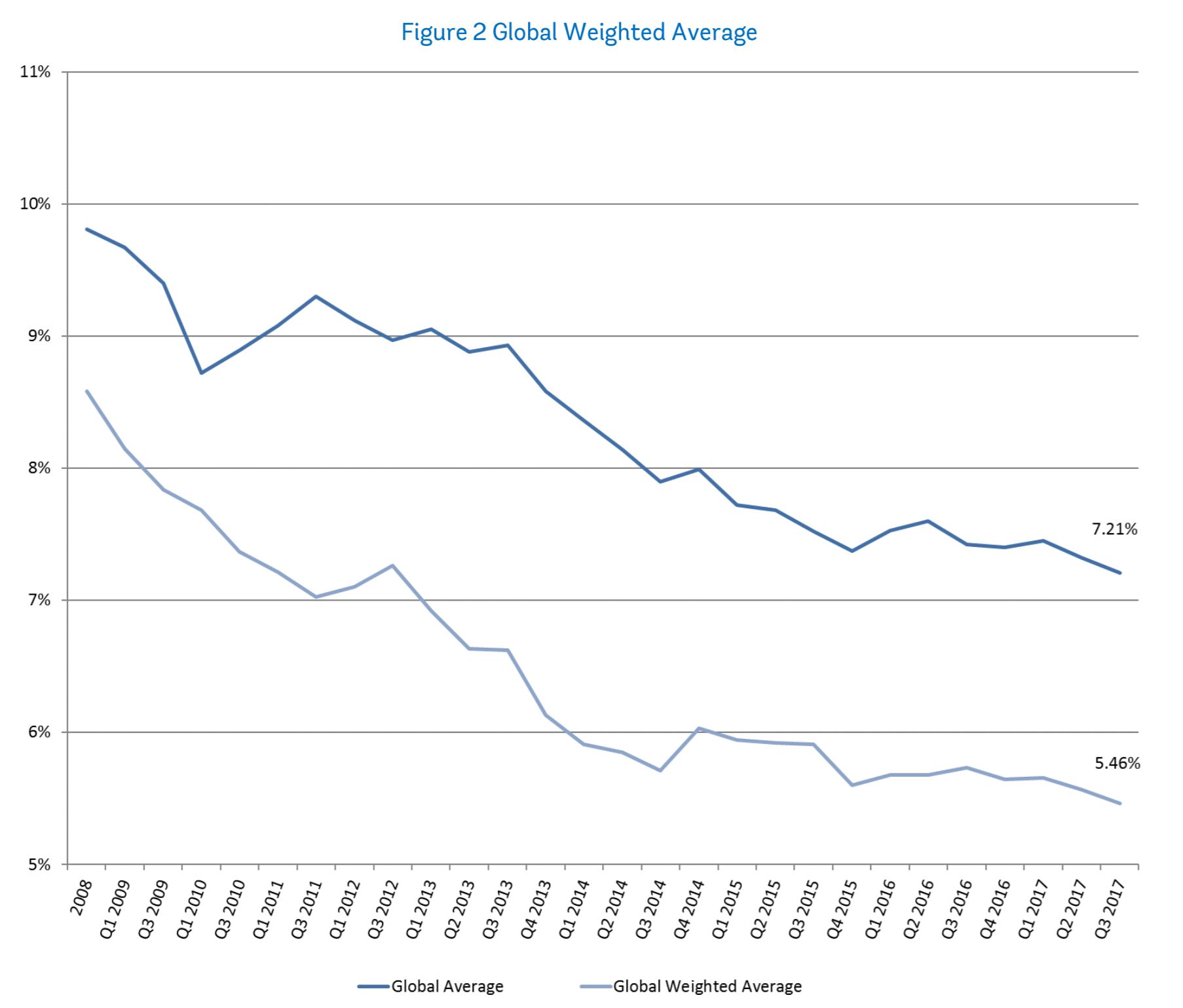

… or read the latest brief from WorldBank. You would quickly discover that the weighted average global margins have been falling to less than 6% (Western Union‘s global margin is ~5.5%, Ria Money Transfer’s – ~4%). So why are we seeing so many articles about high costs of sending money internationally? Because it was the case in the past, and it is hard to change our mindset to a fundamentally different input. As usually happens, high margins attracted more competition and prices have dropped 20-30% in the last 8 years alone:

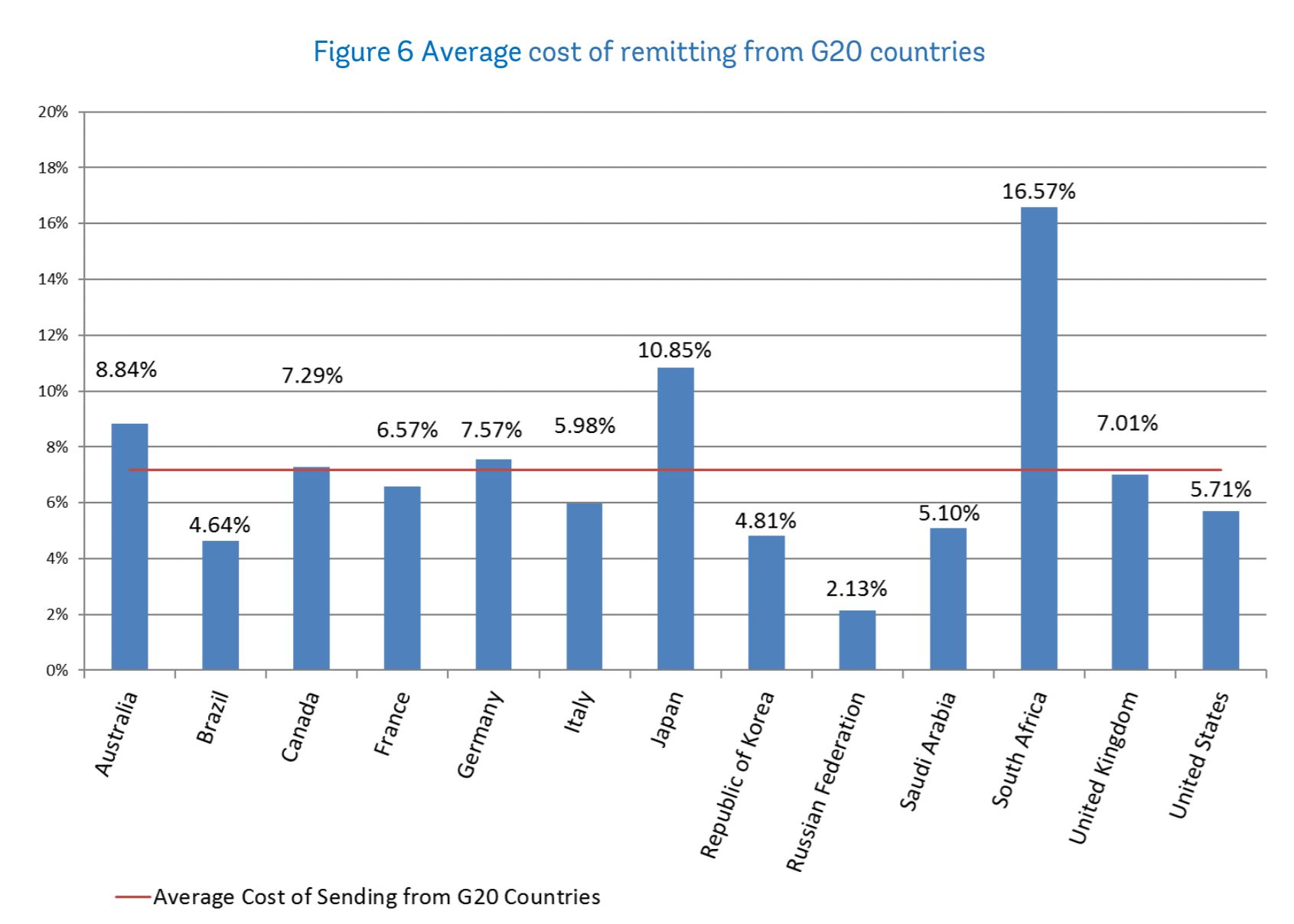

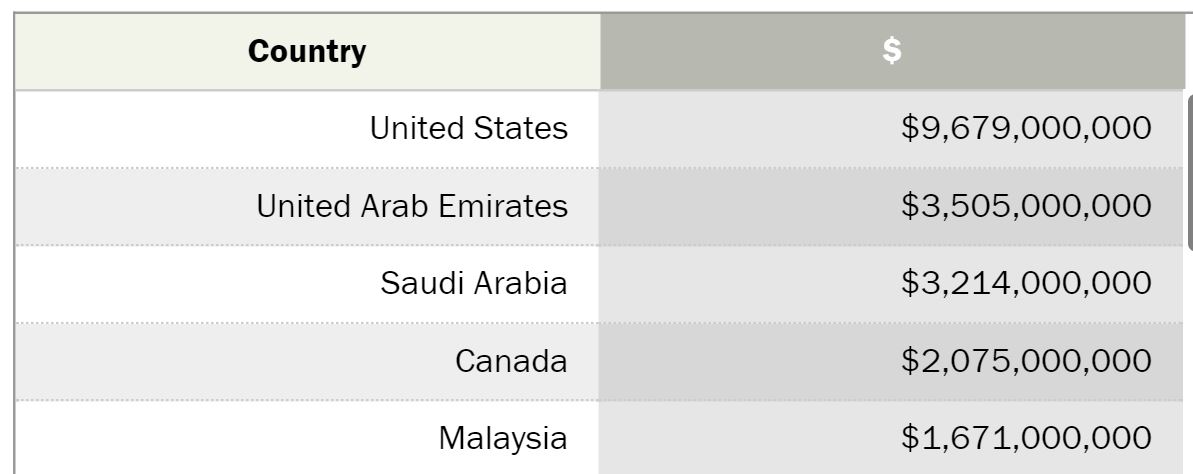

Moreover, there is a huge difference in prices of remittances across top outbound countries:

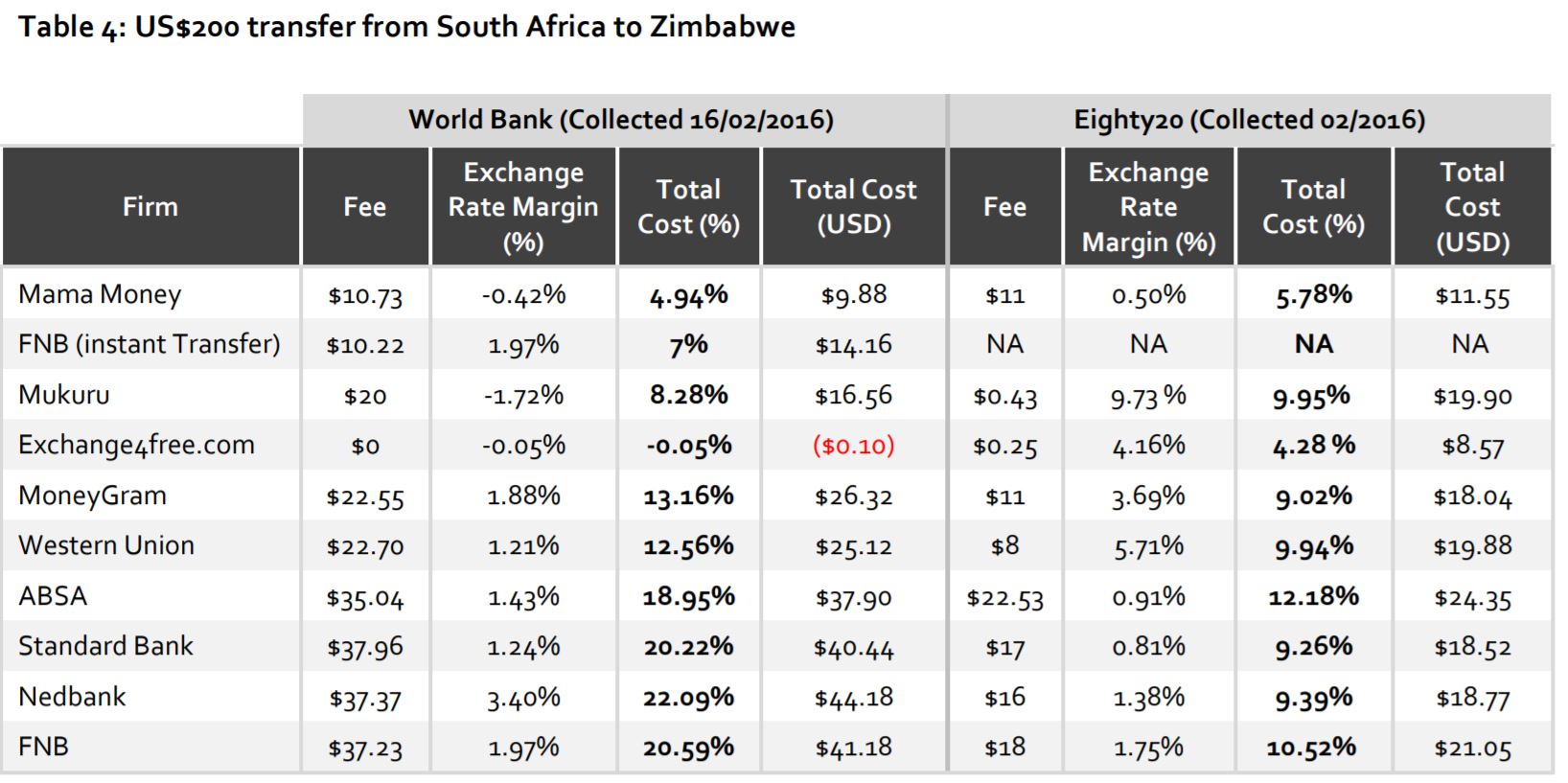

Such data is hard to gather and maintain, so the real prices might be even lower as was discovered in this study:

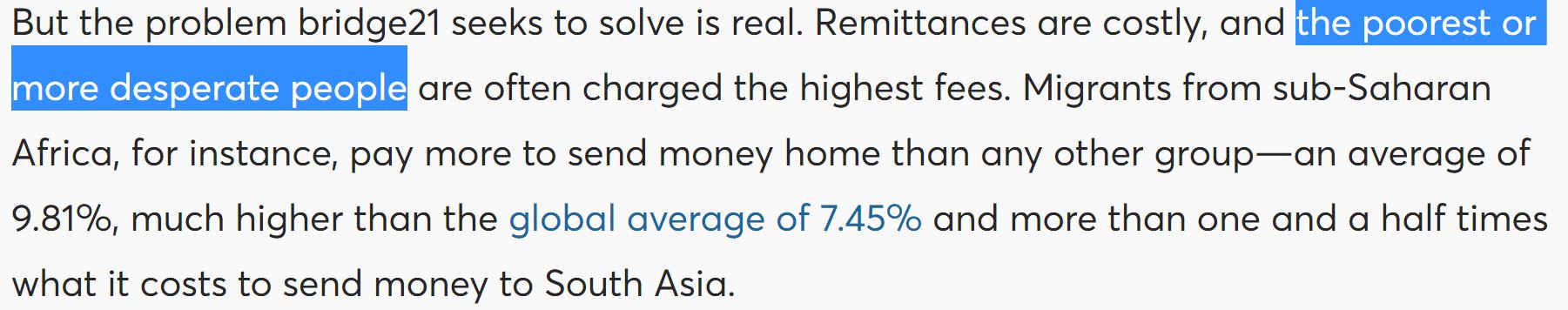

What is causing South Africa to be 5+ times more expensive than Russia? Most experts claim that it is due to two issues, de-risking by banks and exclusive partnership with retailers by Western Union and MoneyGram:

“A major barrier to reducing remittance costs is de-risking by international banks, when they close the bank accounts of money transfer operators, in order to cope with the high regulatory burden aimed at reducing money laundering and financial crime. This has posed a major challenge to the provision and cost of remittance services to certain regions.”

“… the core issue with WU is their exclusivity clauses that have been used for decades to successfully lock markets to one provider, who can then increase their mark-up fees as there is no alternative.”

Neither of these reasons is the case when comparing South Africa and Russia. It is easy to blame “banks” or “Western Union,” but the real root cause is usually with opaque or corrupt governments that favor banks over MTOs and Fintech.

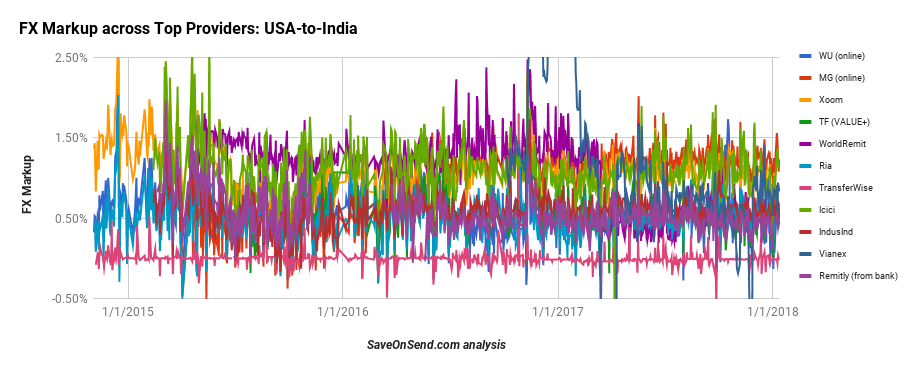

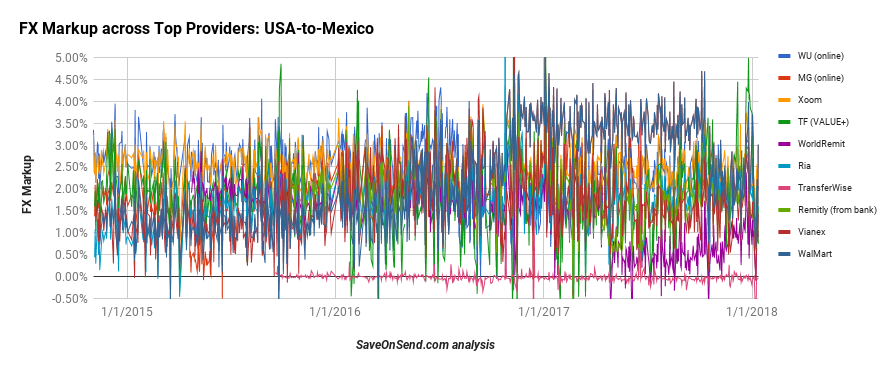

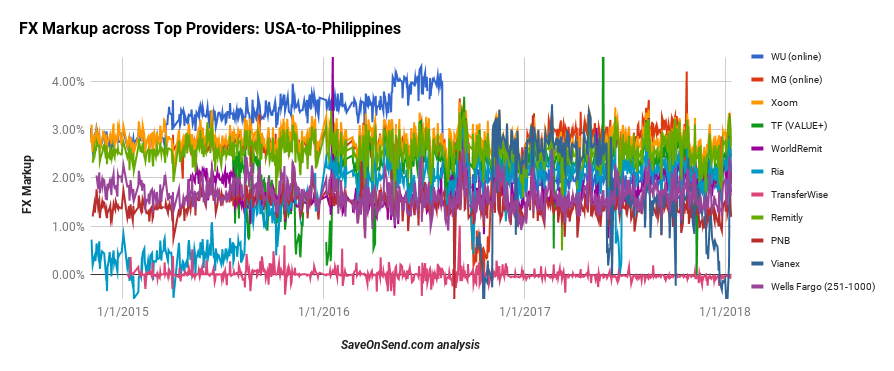

More relevant for Bitcoin-based remittance providers whose customers tend to be tech-savvy early adopters, margins for online remittance in top corridors are in the 1-3% range. For example, in the world’s most advanced corridor, USA-to-India (see reasons in this SaveOnSend article), many providers don’t charge any fees for digital transfers and their FX markups are typically around 0.5-1%:

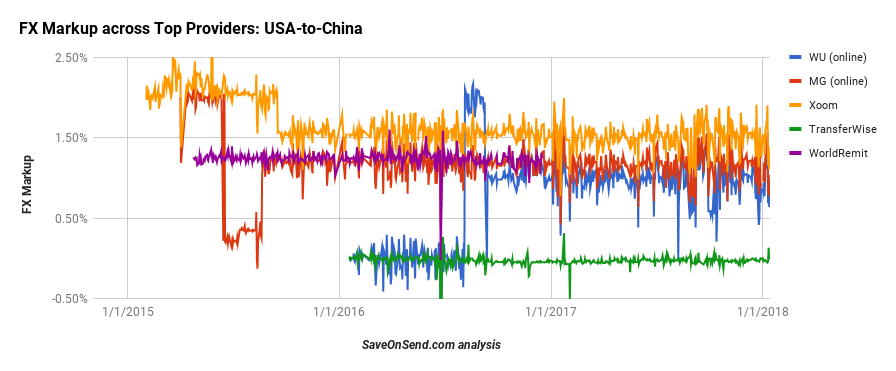

Or review the FX markups for another world’s top-10 corridor, USA-to-China – for 6 months in 2016, Western Union was charging ZERO, no fees or FX markup, for sending money online, from-to linked bank accounts:

It is true that Western Union and TransferWise transfers could take few days, so if Blockchain-based providers could offer their services for free AND in real-time they would have an advantage… as long as their investors don’t mind a business model with a negative variable margin. Some Bitcoin/blockchain remittances startups claim that they already offer such service:

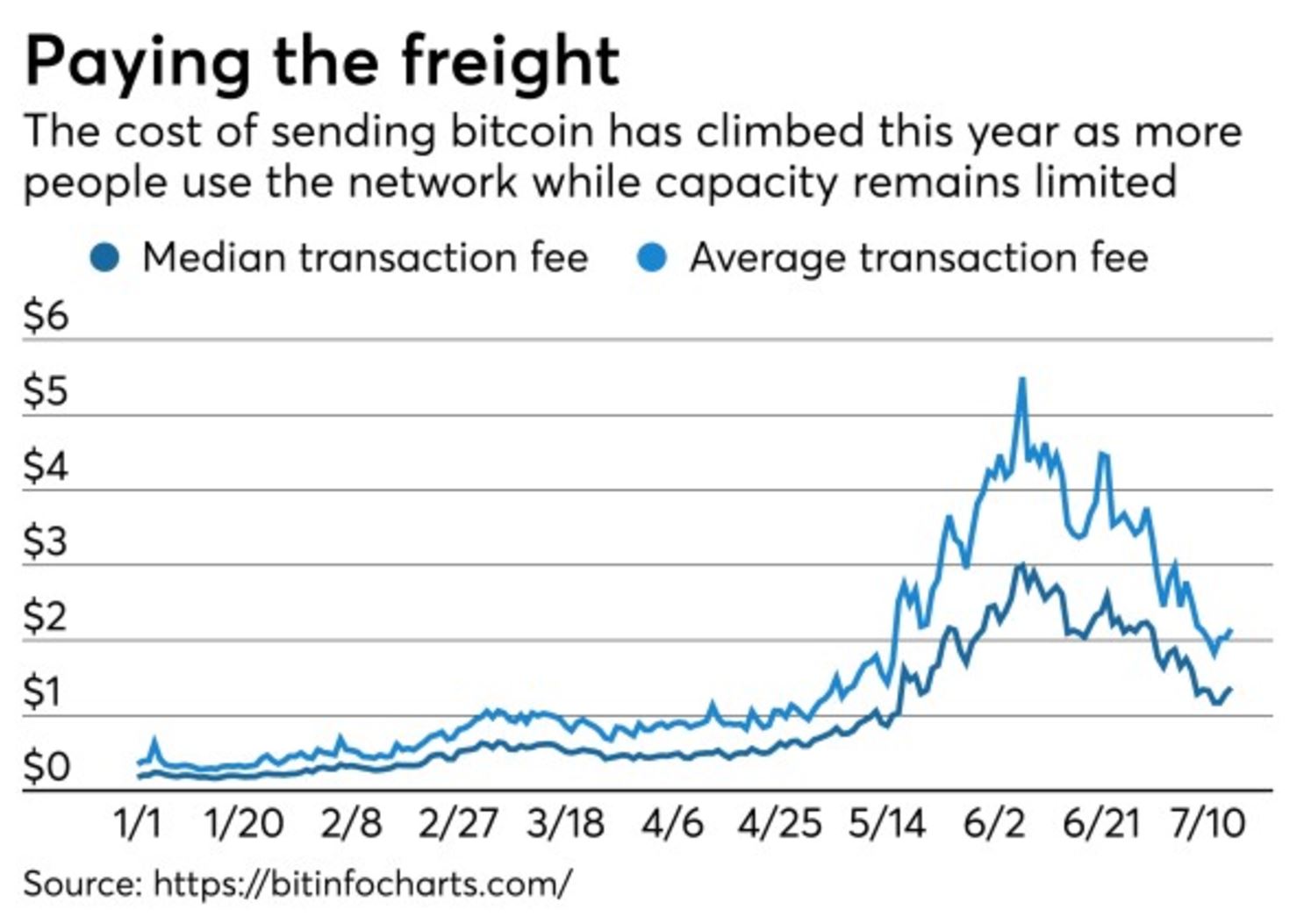

But hiding behind a small font is a misleading comparison between sending money with a popular, easily verifiable fiat-to-fiat method and a transaction originated in Bitcoin with no mention of a Bitcoin-to-fiat spread. On top of that spread, Bitcoin providers are charging increasingly higher fees (source here):

The fee volatility got so bad that in October 2017, Bitspark, one of the more prominent B2B providers of Bitcoin money transfers, switch away to another blockchain.

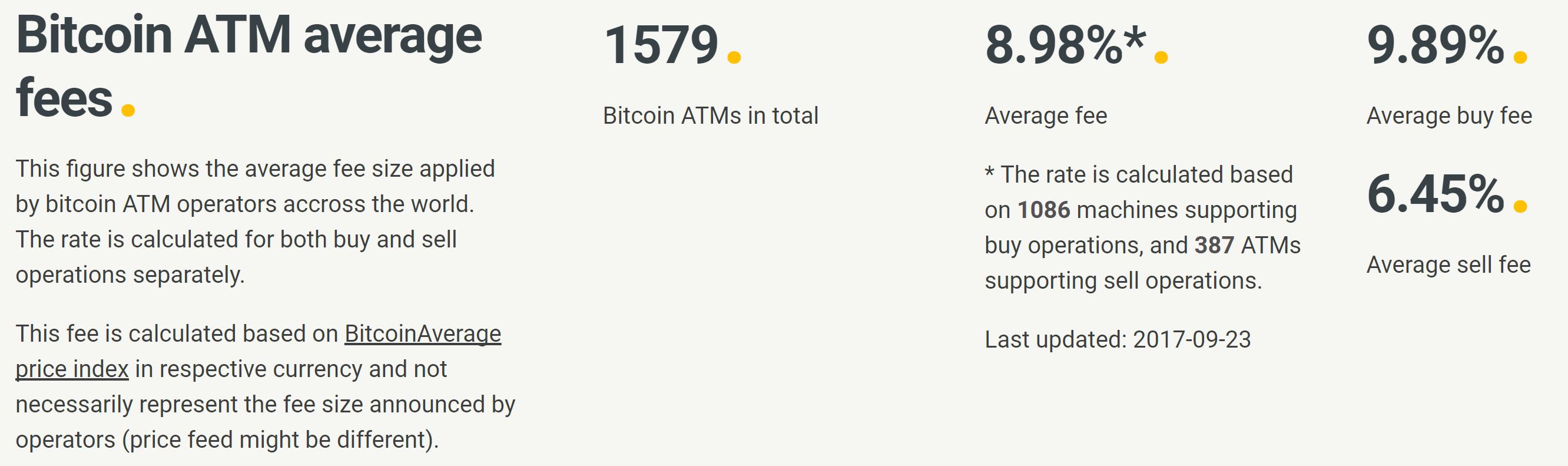

Since 90% of remittances are still received in cash, could consumers save money by receiving cash from Bitcoin / Blockchain ATMs? Nope, it is even more expensive:

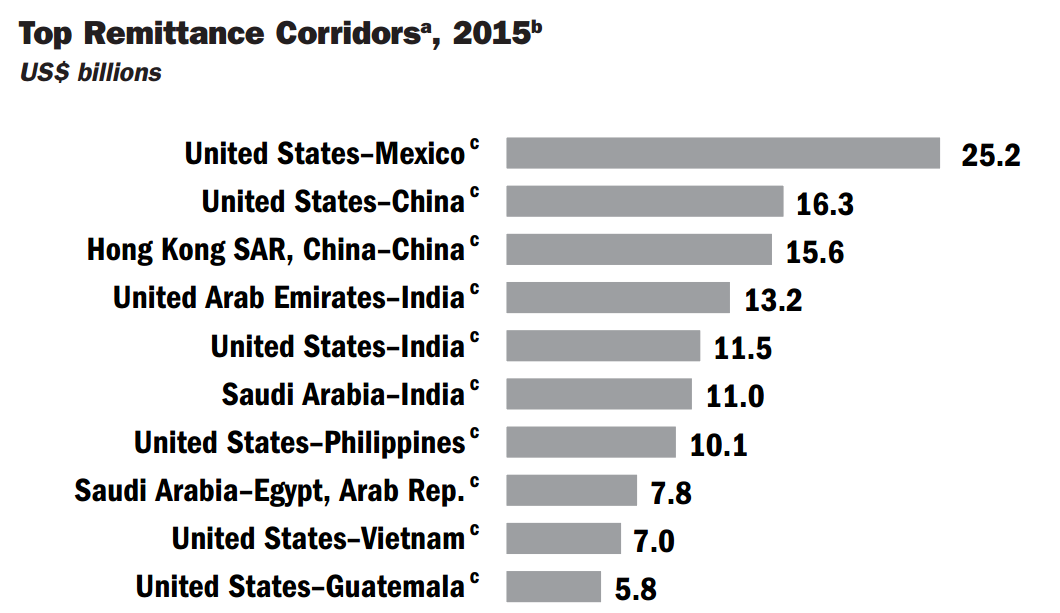

But where could Bitcoin/Blockchain startups significantly reduce cost of remittances? Not where most of them have been focusing so far. In the following top-10 global corridors, each $10B+ in annual volume, including four covered by SaveOnSend app, margins for online transfers are generally below 4%:

Source: https://openknowledge.worldbank.org/bitstream/handle/10986/23743/9781464803192.pdf?sequence=3&isAllowed=y

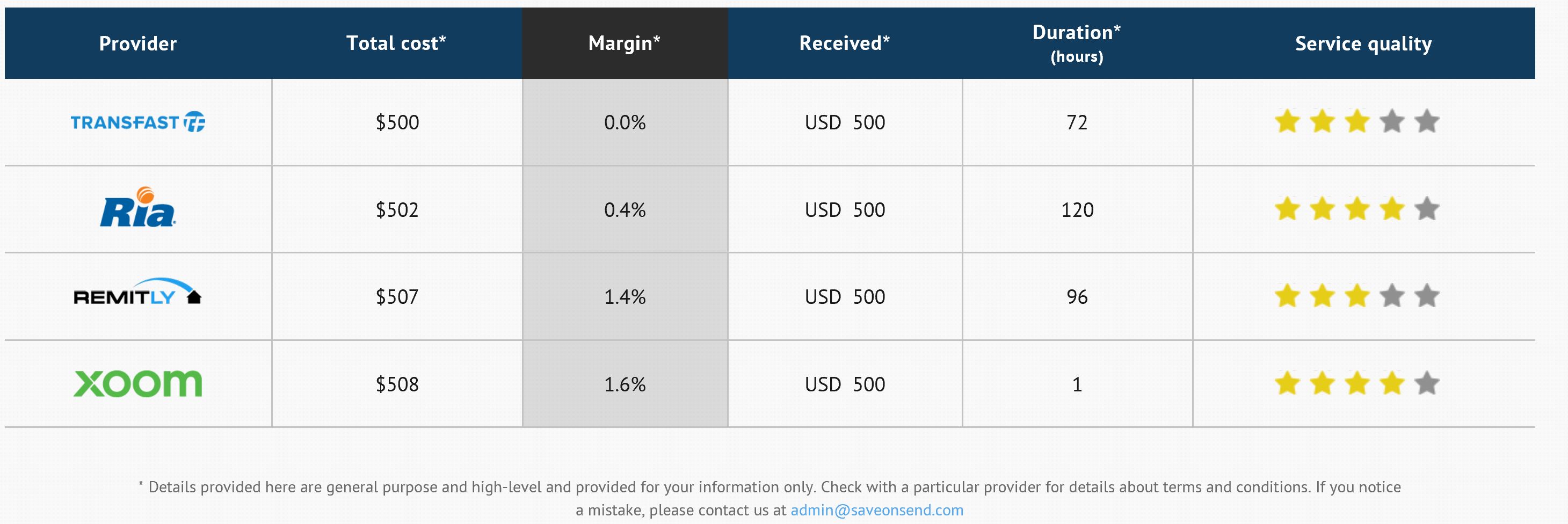

As mentioned before, some of those corridors allow for same currency transfers, for example, USD-to-USD from USA to Philippines or China. This naturally eliminates a need for a provider to manage FX volatility and leads to a very attractive pricing for consumers:

Comparison of providers: money transfers from USA to Philippines, USD to USD, $500, bank-to-bank; January, 1, 2018

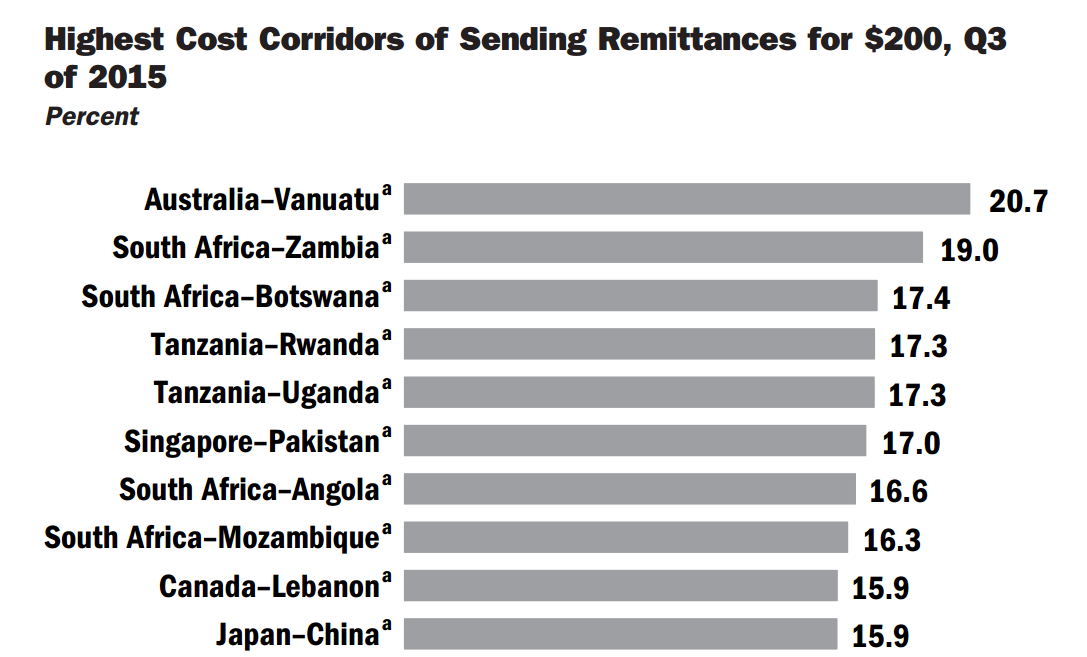

On the other end of the spectrum, there are numerous tiny ($1-5 million) corridors, especially in intra-Africa, with obviously very little competition and, hence, much higher margins:

Source: https://openknowledge.worldbank.org/bitstream/handle/10986/23743/9781464803192.pdf?sequence=3&isAllowed=y

The smaller the corridor the less likely is the return on building localized digital capabilities. That is why, Western Union only enables digital transfers from less than 20% of worldwide destinations (41 outbound countries via a website, as of August 2017, including 18 with a mobile app):

But Bitcoin/blockchain startups are different, right? Unlike profit-maximizing Western Union, these startups were started to help those in need:

Source: https://www.americanbanker.com/news/remittance-startup-uses-bitcoin-as-a-bridge-between-bank-accounts

So which desperate Sub-Saharan Africans did Bridge21 decide to help first? None. The startup began by targetting well-off customers in the world’s largest and one of the most saturated corridors, USA-to-Mexico, where a margin for such service is already 1-3%:

There is a narrow case of “mobile money,” a term that typically implies that money are paid from a customer account with his/her telecom provider. Despite being piloted by Western Union in 2007, mobile payments remain a tiny portion of global remittances mostly used for transfers to few African countries like Kenya and Tanzania. It took off in those countries due to inadequate bank-card infrastructure for payments .

The most famous examples is M-Pesa launched in 2007 by Vodafone. Many experts mistakenly believe that M-Pesa helped poor Kenyans with financial inclusion. In reality, banking industry in Kenya was already rapidly expanding and well-off consumers just had one more convenient option for sending money.

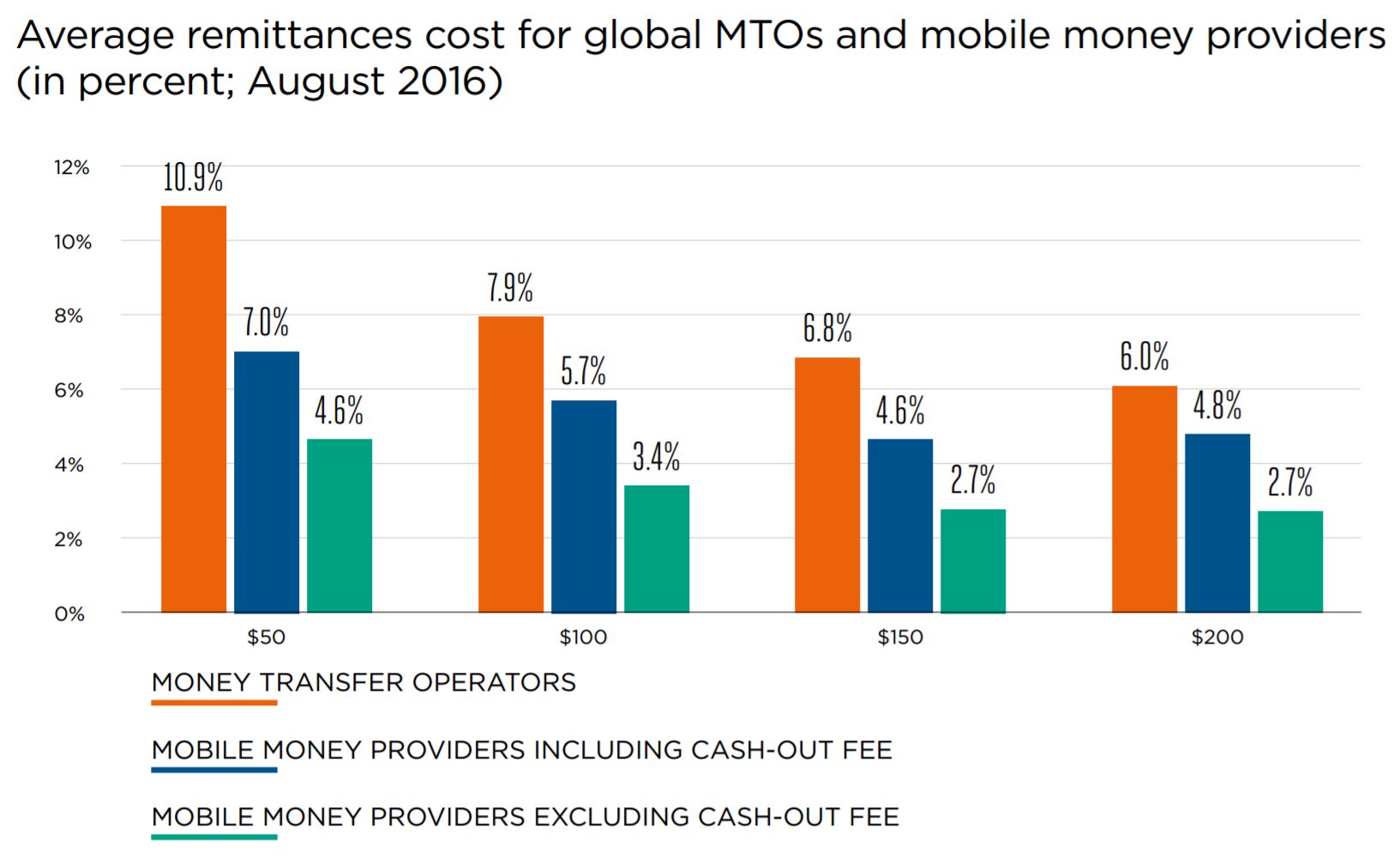

Remittances volumes among those countries in Africa tend to be relatively small and are, thus, outside of focus for digital expansion by incumbents or Fintech startups. As the result, a mobile money method could be the most cost effective options for these corridors when compared to cash-to-cash sending:

Another argument in favor of Bitcoin’s ability to reduce remittance costs is to focus on small amounts with an underlying assumption that such transfers would dramatically increase in quantity (e.g., if it costs little to send $10 to homeland, lots of migrants will begin initiating lots of small transfers). While some increase in smaller amount transfers is expected (read this interview with Western Union’s executive), there is no evidence of a major trend. Even for smaller amounts, some mainstream providers are not charging any fee, in essence, creating variable-only pricing based only on the FX markup (see top three rows in the table below). With those providers, it already costs less than $1 to send money, so even if a Bitcoin transfer is free the price advantage wouldn’t be enough for consumers to care:

Bitcoin-Blockchain can dramatically reduce correspondent banking cost

A lot has changed since 2015 when Western Union denied rumours by Ripple about a pilot. In early 2018, Western Union’s stock price jumped 10% on the rumour:

Shortly after, MoneyGram got in the action signing up for a pilot with Ripple:

“The current model for these payments requires money transfer companies to use pre-funded accounts across the globe to source liquidity. Newer blockchain technologies have the potential to revolutionize this process and optimize capital deployment.”

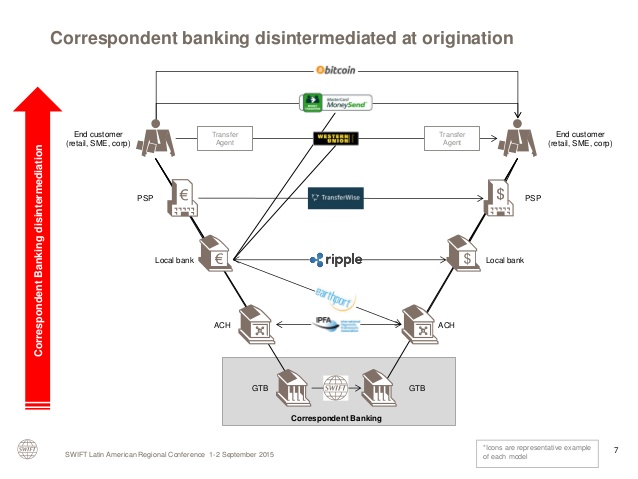

A typical pitch of Bitcoin-Blockchain startup includes a picture like below which shows a multi-step process for customers (retail or business) who want to transfer money internationally. It then naturally proposes a blockchain-based solution which eliminates the need for all intermediaries letting consumers and business interact with each other directly as they do via email:

Even while only planning a pilot with Stellar, the head of blockchain initiative in a large Indian bank is already describing key benefits in this PR article:

“This technology is enabling us to conduct business a lot quicker, cheaper with lower error rates and lower vulnerability to cyber threats. It is helping us eradicate the need for post transaction settlements which are cumbersome and expensive.”

But why after all this time do Stellar, Ripple, OKLink and all other Blockchain B2B providers remain so tiny? Even among non-Blockchain “disruptors” there is not a single provider with good prospects. After 20 years, Earthport revenues are below $50 million, and CurrencyCloud’s – below $5 million after 10. While seemingly intuitive and simple, two conditions would need to be met in order for a blockchain or other solution to present a significant cost advantage over SWIFT: a) costs of those specific back-end processes need to be a substantial component of a provider’s P&L, AND b) existing providers are deploying those processes in a substantially inefficient manner.

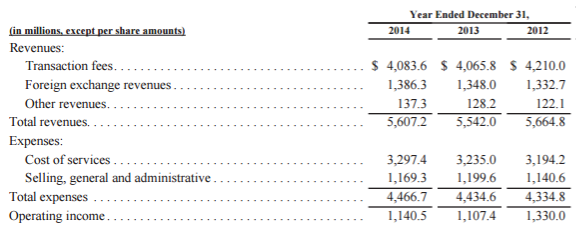

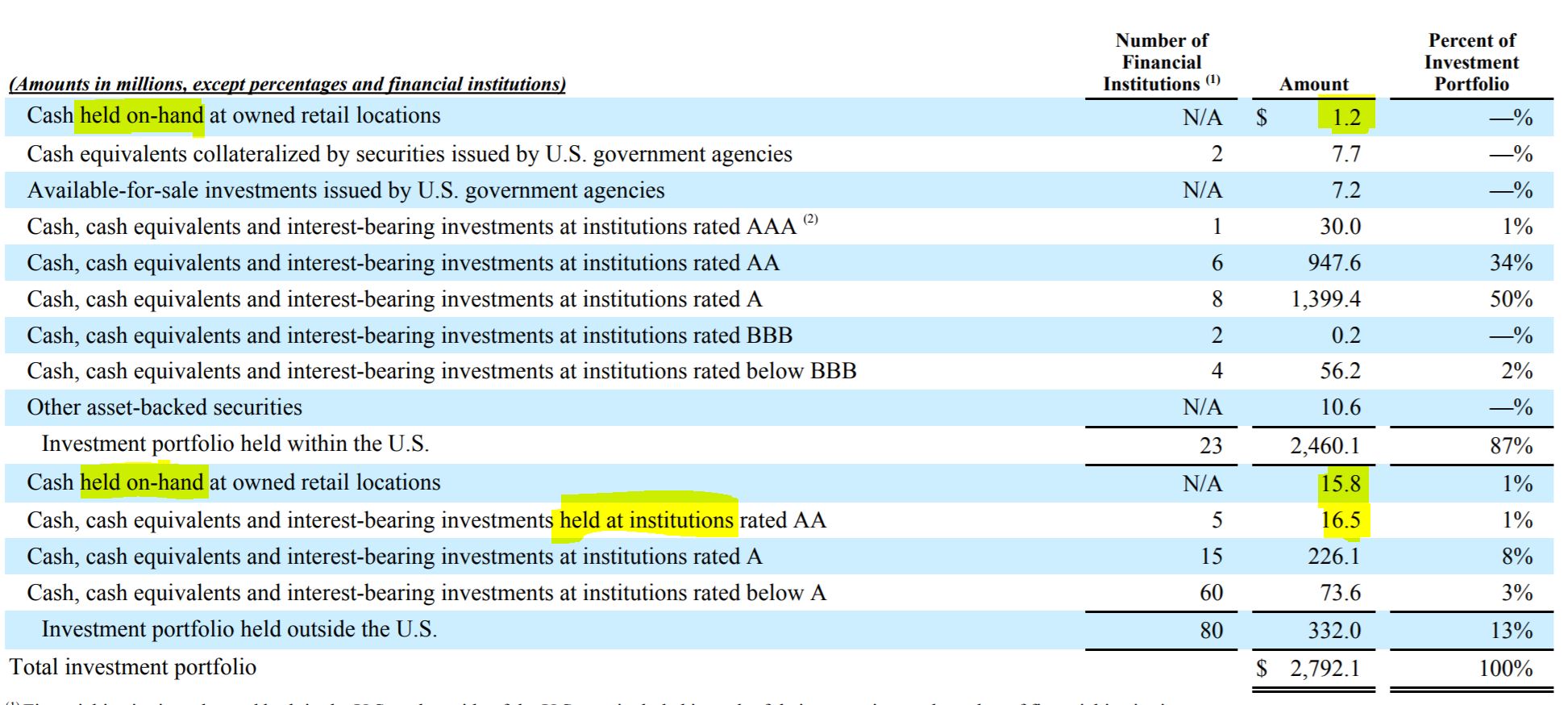

Let’s review financial statements of publicly-traded consumer remittances companies.

It becomes apparent that most of their costs are related to payments for receiving and discharging funds from-to customers, customer acquisition, channel infrastructure, customer service, and risk-management-compliance, not in recording transactions or moving money internationally (read this SaveOnSend article for more details). Hence, providers are eagerly looking for more cost-effective ways to collect and distribute funds vis-a-vis customers, acquire customers, deploy offline and online channels, service customers, manage risks of releasing funds before getting paid… not functions where Bitcoin seems to be offering a distinctive cost advantage. For example, Western Union spent HALF of all expenses in 2014 on “agent commissions” – whether underlying currency is fiat or bitcoin wouldn’t seem to make any difference.

Or, let’s consider fraud-related expenses – the major issue in the remittance industry, like the case of “employee impersonation” at Xoom or when people lie about 1) having sufficient funds in their bank account or 2) not sending money or when hackers take over online accounts. Again, it is not clear why a Bitcoin-based provider would be much better at preventing such “front-end” fraud unless it is a so-called “full Bitcoin” transfer (no on- and off-ramp conversion with fiat). This will be indeed a potentially safer infrastructure, but a very slim chance of mass adoption unless we start seeing billions of dollars spent on PR-marketing globally. More than 20% of Western Union’s workforce is dedicated to a compliance mostly to oversee 550,000 cash agents, but its digital arm performs most of such compliance functions automatically.

And what do large remittance providers spend on correspondent banking? As we describe in this SaveOnSend article, it costs them 0.01-0.1% of revenues and is managed by a global team of 2-5 people. What would you guess are the whole pre-funding amount for MoneyGram? Around $35 million:

Source: http://ir.moneygram.com/common/download/download.cfm?companyid=AMDA-1TA9OX&fileid=933969&filekey=0780C580-C76C-4B94-B33D-1D0F9F7D779D&filename=SEC-AMDA-1TA9OX-1273931-17-4.pdf

Compare that with their compliance and risk management activities which involve 10-20% of the total company staff (for example, it is 15% for Transfast). If in the next 10 years, a Blockchain solution replaces SWIFT, it could unlock about $500 million of value annually for providers. Hopefully, they will pass half of that gain to 250 million migrants who are sending money home, every 2 dollar helps.

Nevertheless, by 2017 most of the large financial institutions and government financial entities were busy experimenting with various distributed ledger technologies, on Blockchain or via more private variants. Such test-first-think-later approach had no positive surprises (examples here, here). Insufficient processing speed, low grade of security, and malfunctioning technology are normal for early test of any network.

“One of the main lessons from this experiment is that the versions of distributed ledger currently available may not provide an overall net benefit when compared with existing centralized systems for interbank payments. Core wholesale payment systems function quite efficiently…”

A seminal moment in the Blockchain-for-back-end debate came in March 2018 when a famed economist, Nouriel Roubini, published “The Blockchain Pipe Dream” which included the following paragraph:

“Bitcoin is a slow, energy-inefficient dinosaur that will never be able to process transactions as quickly or inexpensively as an Excel spreadsheet. Ethereum’s plans for an insecure proof-of-stake authentication system will render it vulnerable to manipulation by influential insiders. And Ripple’s technology for cross-border interbank financial transfers will soon be left in the dust by SWIFT, a non-blockchain consortium that all of the world’s major financial institutions already use. Similarly, centralized e-payment systems with almost no transaction costs – Faster Payments, AliPay, WeChat Pay, Venmo, Paypal, Square – are already being used by billions of people around the world.”

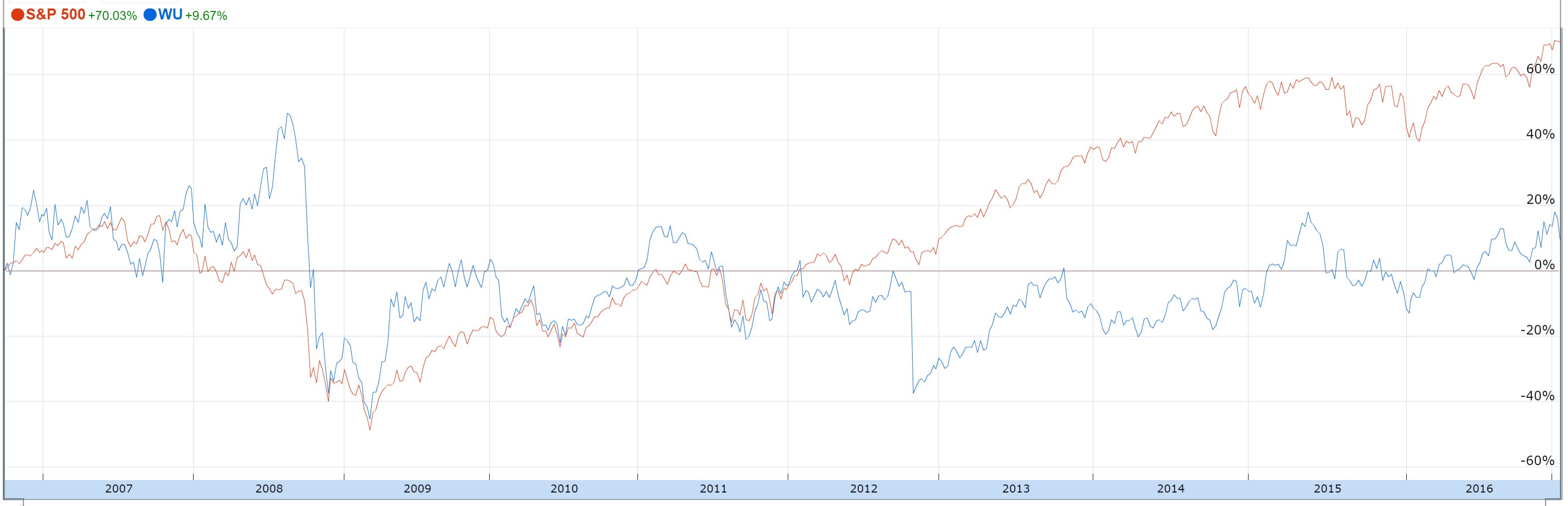

Bitcoin/Blockchain money transfer will destroy Western Union

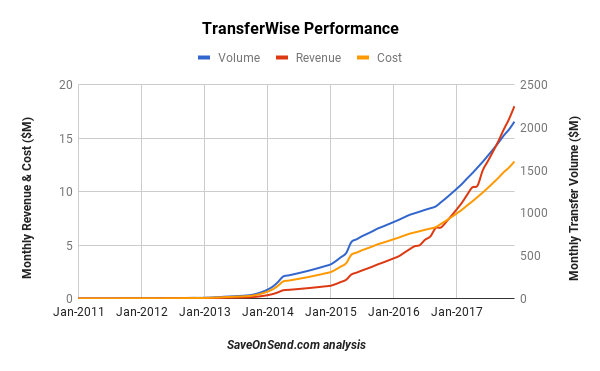

Obsession with crushing Western Union seems to be a huge distraction for many remittance startups, Blockchain or not. One thing is to have a crazy audacious goal, another is to keep talking about it as if such goal could be a reality in the next several years. To put things into perspective, 6 years after launch, TransferWise, the most successful cross-border money transfer player, transfers 1/4th of Western Union’s volumes. Remtily and WorldRemit: 1/20th.

Moreover, TransferWise’s business model is constrained to bank-to-bank transfers, therefore, its revenue would likely to stay marginal in comparison with Western Union’s (learn more in this SaveOnSend article):

If we were to believe Rebit and Bloom, the biggest success story of Blockchain for remittances so far, 20% market share, was in the Korea-to-Philippines corridor in early 2017. It would imply $1-2 million in a monthly transfer volume among its biggest providers, Sentbe and Payphil. OKLinks’ co-founder, Jack Liu, corroborates this magnitude:

Underestimation by @SaveOnSend on #blockchain remittance volumes. Eg. Korea -Philippines is over $1M / mth on @OKLink alone excl. Sentbe

— Jack C. Liu (@liujackc) April 9, 2017

Keep in mind, this particular corridor, with $0.2-0.3 billion in an annual transfer volume, is tiny in comparison to top source countries:

Since Rebit, Bloom, and OKLink have a vested interest, their extraordinary claims must be independently verified. For example, even such relatively small volume seems unlikely as the central bank of Philippines estimates volume of remittance transactions involving ALL inbound corridors and ALL virtual currencies to be around $2 million per month. The claims of “20% market share” have been continuously re-printed after the first appearance in September of 2016, always with absolutely no evidence. In public and private interactions, SaveOnSend repeatedly asked all these startups to send us data for validation… and we are still waiting:

Thanks, Jack! Please email us data with proof of monthly trends and we will be happy to verify and publish

— SaveOnSend (@SaveOnSend) April 9, 2017

Understanding why this corridor and these startups have been so much more successful than anyone else globally is a crucial next step in Bitcoin’s evolution for remittances. Instead, we keep seeing another clever way to misinform a general public about the world leader in remittances that transfers 1,000-10,000 more funds than the largest Bitcoin-enabled startup:

In the meantime, Western Union has proven to be quite agile in adopting to digital evolution. It was the first to provide an online channel in 2001, the first to experiment with mobile money in 2007, and has managed to maintain a resounding lead in digital cross-border transfers:

Western Union was also the first among well-known remittance providers investing in blockchain startups and experimenting with blockchain:

As you saw in the previous comparison tables, Western Union is at times less expensive than some of the so-called Fintech startups (see this SaveOnSend article for more on that topic). For example, look at the margins across providers in one of the world’s most competitive and largest corridors, USA-to-India:

And that maybe the biggest “blind spot” of Blockchain-based startups. They have an image, a wishful thinking, of Western Union as a cash-only business which missed telephony and kept hanging onto telegraph. The reality is quite different. Western Union would exploit Bitcoin-blockchain rails as soon as they become a viable alternative. Remember, profits and costs are in the first and last mile not in the rails (read this SaveOnSend article for more details). Finally, while Western Union’s market share and stock price have been stagnating, there is yet no signs of imminent demise:

Source: http://secfilings.nasdaq.com/filingFrameset.asp?FilingID=12437951&RcvdDate=12/20/2017&CoName=FINTECH%20ACQUISITION%20CORP.%20II&FormType=8-K&View=html

The only reason preventing mass Blockchain/Bitcoin money transfer adoption is [enter your favorite]

Articles like this highlight something unique about stakeholders in a Bitcoin money transfer community, both startup founders and their investors. Rather than learning and embracing a challenging reality of consumer remittances today, they prefer to believe that Bitcoin by itself is a “game-changer” for remittances. The are betting on a miracle of new technology taking off once enough remittance consumers hear about Bitcoin features. What would drive such mass-awareness is typically some “game-changing” event, pick your favorite:

-

Donald Trump becomes a president and halts all remittances for undocumented migrants from Mexico

-

Economic collapse in a large country results in hyperinflation (Greece, Venezuela)

-

A large retailer agrees to accept Bitcoin for money transfers

-

Bitcoin remittance startup cuts its fees and conversion rates to zero

-

Low-income consumers learn to use advanced smartphones

-

Government supports adoption of Blockchain/Bitcoin

Rather then asking why NO ONE is using Bitcoin/Blockchain for legally sending money cross-border, including their neighbors, families, and friends, the payment industry pundits prefer to wonder about poor people in mysterious Africa (read more here):

“Potentially, Africa’s huge unbanked population combined with the burdensome process of opening and operating a bank account should make Bitcoin an instant hit. However, its adoption has been irritatingly slow even though the basic infrastructure is not missing. It is estimated that by the end of this decade that 80 percent of the continent’s more than 1.2 bln population would be using Smartphones. Then what hinders Bitcoin penetration in Africa?…”

Why do same consumers who waste a trillion of dollars annually on cigarettes, junk food and alcohol don’t want to embrace this supposedly game-changing innovation? Why in the same period have non-Blockchain/Bitcoin Fintech startups like TransferWise grown so much faster?

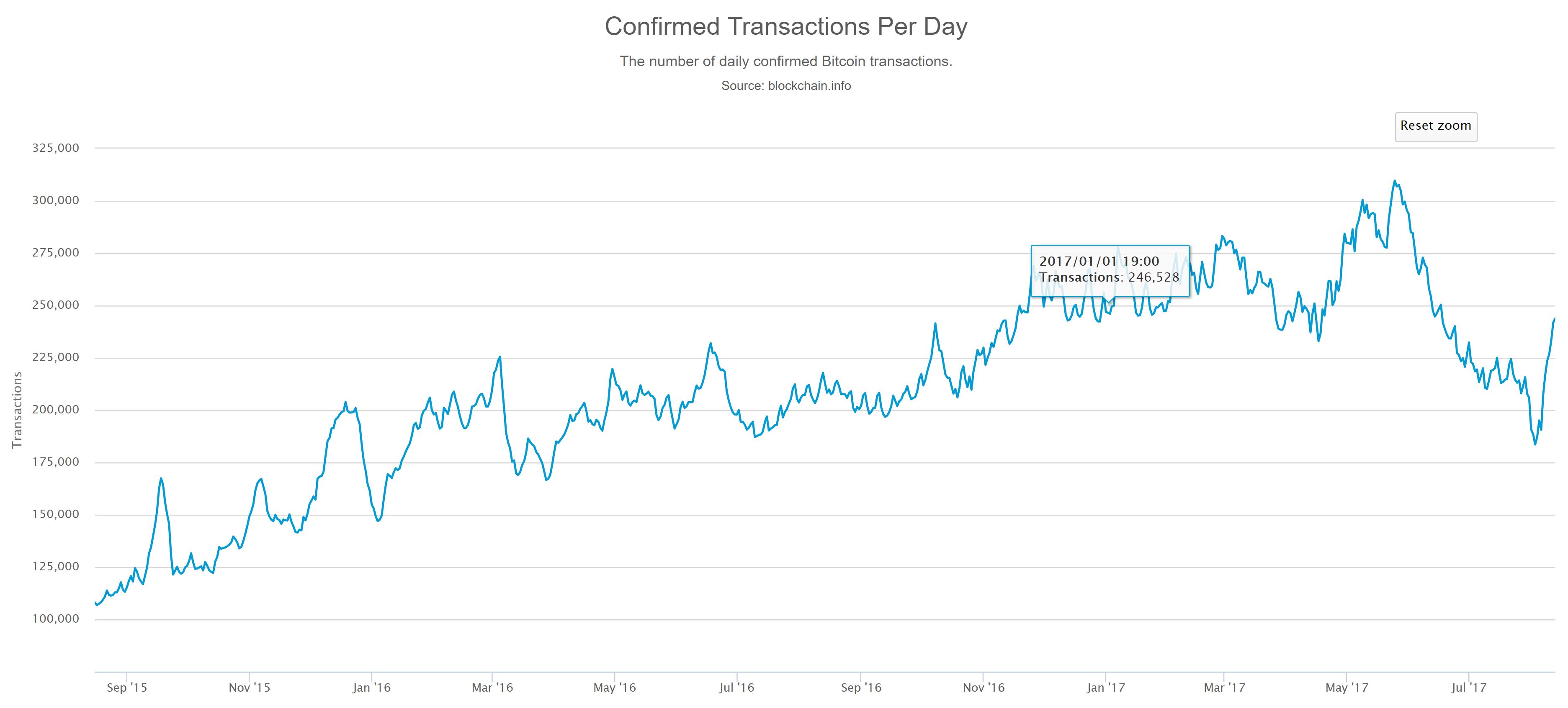

Lack of of any noticeable Bitcoin / blockchain adoption is a sobering reality almost 10 years after the release of Version 0.1 – it is evident across all regions and use cases. And the excitement of ever rising price of Bitcoin seems to have little impact on stalling number of transactions:

Do you remember exuberance in 2014 when thousands of merchants agreed to accept Bitcoin? Let’s check on status in 2017:

-

CheapAir.com: “…it certainly hasn’t taken off…”

-

Dish Network: “…we have not seen growing enthusiasm…”

But you might have seen some outfits reporting an amazing growth. Here are the headlines from BitPay’s report on achievements in 2017:

-

on pace to process over $1B annually in bitcoin payment acceptance and payouts, and we’ve already grown our payments dollar volume 328% year-over-year from 2016

-

NewEgg has more than doubled its bitcoin sales from last year

-

seen a more than doubling in transactions going to Latin American merchants since August of last year

-

US card program alone grew by 1583% year over year (from August 2016)

Looks impressive, right? Except, notice that BitPay conveniently does not mention either a base for comparison or a number of active customers and transactions. Dollar volume growth of 300+% would be impressive for a regular merchant processor. For a Bitcoin-based provider, when a Bitcoin value has grown 1,000-2,000% in the last year, such “growth” number seems more like a loss.

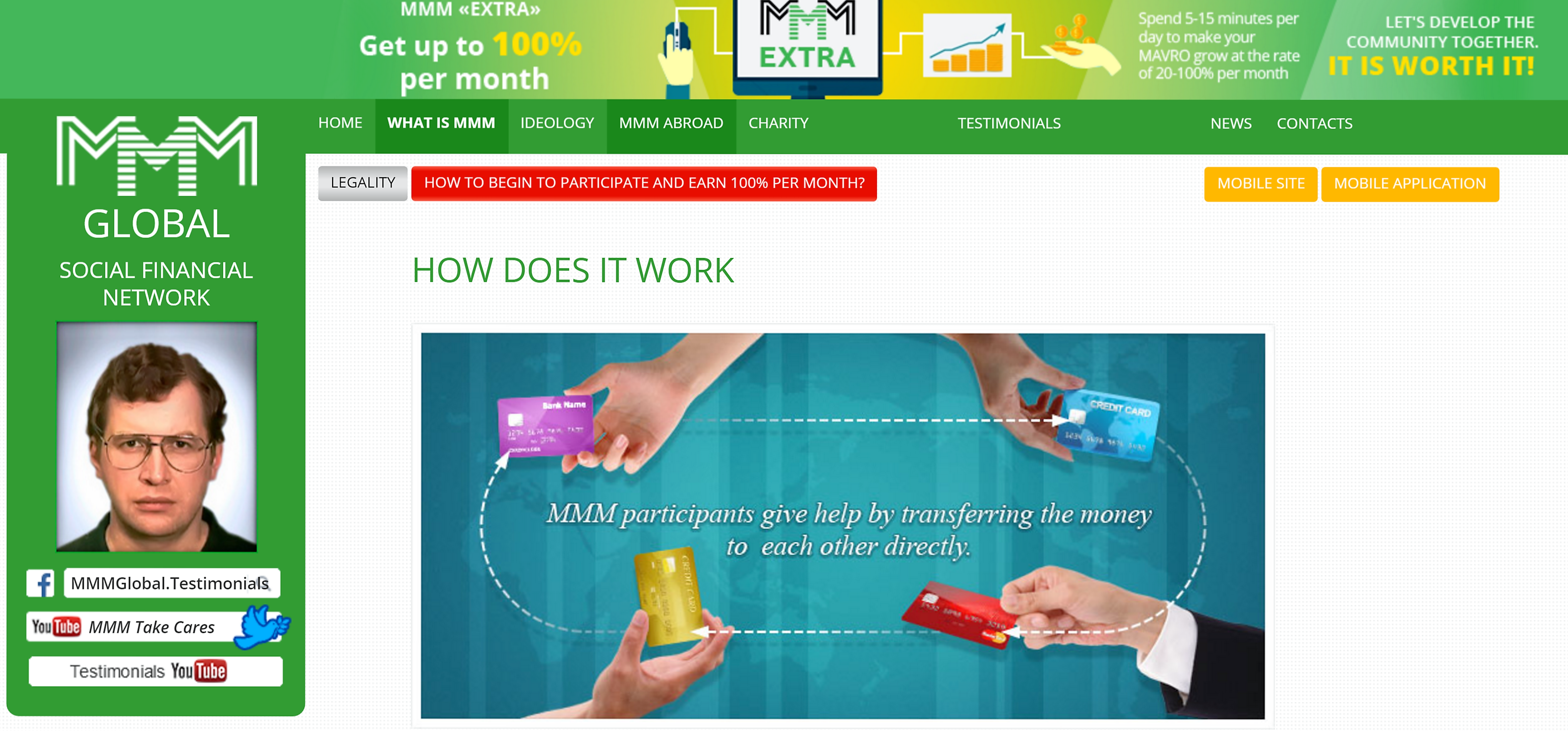

While Bitcoin and blockchain impact has been invisible for legal money transfers and only payments for shopping, several use cases represent a lion share of all usage

-

Legal but no intrinsic value: 1) investing in cryptocurrency, 2) trading on discrepancies in prices across exchanges

-

Illegal but with intrinsic value: 3) ransomware, 4) money laundering, 5) tax evasion, 6) ponzi schemes

By definition, no one can really know the volume of illegal cross-border transfers/payments. One of the most prominent industry experts, Hugo Cuaves-Mohr, estimates it in $150-200 billion range. As this somewhat amateurish video is trying to explain, for 10-15% premium tax evaders buy Bitcoin for cash in countries like India and China, then sell it on exchanges in a developed country (Bitstamp or Kraken), and deposit laundered money in that country.

Because of Blockhain/Bitcoin’s widespread role in money laundering and tax evasion, the US tax authority (IRS) requested the names of Coinbase customers in late 2016 and won the case in court in late 2017.

A clear leader among ponzi schemes is MMM claiming 250 million users in 118 countries, 3 million in Nigeria alone. MMM accomplished it while hiding from governments, with cheap websites and offline agent network. Watch this short video and ask yourself why not a single Blockchain/Bitcoin startup for cross-border money transfers has been able to accomplish 0.1% of MMM scale:

Even more grounded Blockchain/Bitcoin supporters feel it is reasonable to compare Bitcoin with Skype and WhatsApp and other world’s biggest consumer platforms:

The irony of above meme (created in early 2016 and resurrected in late 2017) is that no one who seriously shares it is using Bitcoin as his or her primary bank. Why? They seem to forget two most basic principle behind success of any innovation:

1. Manifestation of product-service virality takes weeks-months not years. WhatsApp and other “viral” giants spread like fire to millions of users and didn’t require second guessing. Nothing even remotely close has been transpiring with ANY bitcoin-based apps, and the active user base of the ones focused on remittances is typically measured in hundreds. Yes, it is possible, that one day in the future somebody will invent a fundamentally better bitcoin remittance app than anything available on the market today, but that has nothing to do with existing startups and their investors.

2. The happier consumers with their existing choices and the more work required by them to adopt, the more branding and marketing efforts are required to initiate said adoption. They should also embrace a harsh implication that an abundance of satisfactory options impedes adoption not only among customers but also among necessary business partners. Why would a grocery store engage with a brand new provider that has a miniscule remittance flow if they already have a satisfactory working relationship with “Western Union” and other well-known brands? Read how CEOs-founders of Bitcoin remittance startups describe this particular challenge: BitSpark, Abra and Rebit.

So the biggest barrier to mass adoption might be that a Blockchain/Bitcoin community is still dominated by idealists who are stuck in the “Bitcoin=Internet” paradigm rather than skeptical practitioners who would consider a new payment rail and cryptocurrency to be just another novelty. Whether it is a new brand of vodka, clothes, car, or remittances, the real “game changer” is in superb execution of more-or-less standard playbook. Miracles are known for tardiness.

Specific examples of Bitcoin money transfer providers

Keep in mind that for all their talk about transparency Bitcoin remittances startups remain secretive about their performance, so we wouldn’t be surprised if any of them disappear tomorrow.

Graveyard – closed or pivoted away from Bitcoin consumer remittances:

-

October 2017: Bitspark pivots to B2B (investors: RGAx)

-

July 2016: Freemit shuts down (investors: Alchemist Accelerator)

-

January 2016: Romit shuts down (investors: 500 Startups, AltaIR Capital)

-

November 2015: BitPesa pivots to B2B (investors prior to pivot: DCG, Pantera)

Launched in 2013, BitPesa initially was the best-known “use case” for Bitcoin consumer remittances to few countries the middle part of Africa. However, as BitPesa kept struggling with gaining traction among consumer remittance users, it discovered that its typical early adopter was a small business owner who occasionally sends money. Facing this reality and struggling in the initial outbound market, UK, BitPesa expanded its marketing efforts to potential senders from other countries like Canada and USA and began targeting B2B cross-border payments (see informative presentation by BitPesa’s CEO). BitPesa has raised close to $2M to date and its transfer volume has been growing at 30%/month from $50K in January 2015 reaching $400K by July. As of November 2015, nearly all of its customers were using BitPesa for business needs.

-

October 2015: Bitstake->NairaEx

-

August 2015: Beam shuts down (investors: MTT Group)

-

July 2015: Cryptosigma->Toast (investors prior to pivot: Startupbootcamp)

-

June 2015: 37Coins shuts down (investors: 500 Startups)

-

April 2015: Buttercoin shuts down (investors: Google Ventures, Y Combinator)

-

2015: HelloBit shuts down (investors: 500 Startups)

Abra (A Better Remittance App) deserves a special mention in this section.

When on September 10th, 2015, Abra announced that it raised $12 million in funding, it was a seminal moment for Bitcoin’s evolution for remittances. For the first time ever, there was a startup with enough funds to acquire 100,000+ remittances customers. This made Bitcoin for remittances no longer a hypothetical question. We were finally able to compare Abra’s progress with initial trajectories of established remittances startups:

-

TransferWise: raised $7 million in its first 2.5 years, reaching $35M in monthly transfer volumes

-

WorldRemit: raised $7 million in its first 4 years, reaching $50M in monthly transfer volumes

-

Remitly: raised $11 million in its first 3 years, reaching $2M in monthly transfer volumes

By August 2017, Abra had just 73 users a day…

Abra’s vision was indeed groundbreaking. Enabling consumers to act as ATMs could eventually be a replacement for hawala and catalysis for speeding up a slow shift from off- to on-line method of sending money. Abra was not looking to modify behavior of end-users. It was hoping to enable a cash-to-cash method habitual for 90% of remittance transactions. The fact that Bitcoin is somehow involved was also purposefully hidden from consumers also not apparent (check out Abra’s landing page).

Abra was launched in February 2015 with a fascinating premise, but a comical-borderline-bizarre pitch. At that point, it was hard to imagine a better parody on the disconnect between bitcoin’s ardent fans and reality of money transfers than this presentation and the follow-up reaction. Please watch it, only 6 minutes:

This pitch won 2015 “LAUNCH Festival” Award. Moreover, the Abra app was hailed as the finally arrived “uber for remittances” and “Western Union killer.” If you are not inside of the bitcoin bubble, you could be forgiven for chuckling few times while watching the video. Abra presentation starts with: “I wanna talk to you about Mexican immigrant named Bill” and proceeds with painting us a story of human suffering of someone in Mexico who has to “drive 2.5 hours” to the nearest cash agent. Abra had a solution for those apparently greatly inconvenienced folks: “human teller”… and ignorant judges loved such silly idea.

Considering the ubiquity of cash agents, it is not hard to imagine a place that is so remote. There are numerous small villages, 50-100 residents, in such hard-to-reach places which remain there for historical rather than economic reasons. For anyone who ventures to such villages few gaps become apparent in Abra’s presentation: a) Mobile data connectivity, which could be spotty even around NYC, is usually non-existent once you are this far from larger cities and infrastructure, there is just no business case for deploying such capabilities, b) comfort-trust of technology, especially as it relates to money is far behind in its evolution, c) while it is usually very safe to live in those communities, the overall protection coverage by government is quite limited. So this “uber for remittances,” “killer app” will be deployed to THESE areas?!

There might be definitely one segment who could be eager early adopters: criminals. There is finally an app for them which allows to quickly identify somebody with money in a vicinity and thus significantly improve effectiveness of victim targeting.

Joking aside, even if we stop worrying about common sense and just go with this story, how would it look as an investment? Spending on localization, wireless data, customer service, etc., all to serve few people in remote areas seem understandable if those were marginal expenditures to piggyback on key metropolitan areas (same way how Western Union can afford 30% of its 550,000 agent locations without any remittance activity), but not as a targeted investment.

But investors who gave Abra $12 million had no inclination to waste money by targeting remote villages. Helping “poor” is a good PR, but as all other fintech startups, Abra was also going after tech-savvy consumers in major metropolitan areas of top global remittance corridors. It quickly became apparent that “P2P” was also just a PR. Most of Abra’s distribution in Philippines were not “human tellers” but the same pawn shops used by traditional remittances providers.

From the beginning, there was also an obvious question about Abra’s ability to make profit considering that they only charge 0.5% on each side of a transfer assuming all FX risk. At least for now, bitcoin spreads are higher and hedging is very hard to find, hence, it is quite expensive (mining businesses in developing countries are already looking for the same hedge). If we add Abra’s own gross margin and each side’s markup of 1%, the total margin gets to around 3% which is on the high-end for corridors like USA-to-Philippines (check SaveOnSend app for other corridors):

Abra started by trying to sign up thousands of “human tellers,” but nine months after getting funded the startup pivoted to a very different offering: typical bitcoin wallet focusing on consumers with linked bank accounts and offering a cash-out via convenience stores. Abra’s initial focus was on the USA-Philippines corridor which is in bull’s eye of all incumbents and top remittance startups. Learning this a hard way, sixteen months after a $12 million funding round, Abra all but gave up on its original pitch. It now focuses almost exclusively on a wallet play and pitching it as a global domination:

US -> PH is a large corridor, but well served. Next we'll do Anywhere <-> PH (2 way, global). More compelling value add/differentiation.

— Abra (@AbraGlobal) January 18, 2017

In the end, Abra’s initial focus on remittances became a repeat of another venture in same space, Boom Financial. Founded in 2008 by Abra’s management, Boom was pitched as “the first cross border mobile banking service in the US” (on a side note, same was claimed in 2012 by Remitly). Over 2008-2012, Boom raised $28 million from RRE Ventures and others, and… nothing.

Out of all failed bitcoin remittances startups, Abra’s pivot was the most disappointing. On paper, its target segment and user experience were distinctive and had a promise of making a real change for a large portion of cash remittance users. Instead, Abra became another mundane wallet app for better-off consumers with bank accounts. In just 2 years, Abra’s focus changed from helping “Mexican named Bill” with cheap remittances all the way to helping affluent American Express cardholders to invest in Bitcoin for a 4% fee:

In October 2017, Abra raised $16 million to offer credit installments… “Mexican named Bill in a remote village” will have to wait.

We can only hope that a blockchain technology evolves, and some other startup could finish what Abra started. Of course, another hurdle that such startup would need to clear is a regulatory approval of its business model. Abra wanted to claim that it was just a technology company that didn’t own money transfers. That would have allowed Abra to avoid spending time and effort on compliance and licenses (see another SaveOnSend article on that topic). While it would be a welcome change for governments to embrace Abra’s interpretation, it is unlikely.

Still Active B2C Startups:

Rebit.ph

So far, Rebit has raised only $100K. This is a minuscule amount considering that it costs around $50 to acquire a new customer. Rebit’s more fundamental challenge is that its model is not fundamentally different from a typical remittance provider – read this article from its former insider.

Its repeat customer base is in hundreds, but Rebit is also attracting one-off users, in total generating 50-100 daily transactions. Rebit doesn’t charge fees making money on the FX-Bitcoin spread. Read Rebit’s extensive update and Q&A on Reddit.

bridge21

Startup was launched in January 2017 targeting the world’s largest remittances corridor: USA-to-Mexico. bridge21 is capitalizing on a difference in Bitcoin pricing between USA and Mexico at times offering a below interbank exchange rate. Founded by a former Western Union executive and is not shy of a standard PR, bridge 21 grew to $100K in weekly volume of money transfers in the first 9 months (which is in line with the initial trajectory of non-Bitcoin remittances startups).

Other interesting startups to follow:

Question for YOU: which bitcoin money transfer provider do you think has a practical chance to reach 1% market share in ANY global corridor in the next several years? Please describe your brief rationale in the comments section below.

Regulatory aspect of using Bitcoin for money transfer

Compliance with KYC-AML regulations is another existential questions for Bitcoin remittances. Banks are already dropping small regular remittances providers and even have serious concerns about working with the largest providers of remittances (read more in this SaveOnSend article). Here is a senior banker describes why their bank won’t open a correspondent account for a Bitcoin/Blockchain provider of remittances:

“Our bank is careful NOT to aggressively address new frontiers given potentially high penalties or even simply being in a penalty box by regulators. Concerns are obviously similar to those with regular providers of remittances: money laundering, gambling, drugs, or within other prohibited industries. Unfortunately, I don’t see a path forward in the near term: we won’t be able to monitor or control their flows even if we were to hire more people in compliance or invested more in the systems.”

Read this article on whether such compliance is even feasible. Faisal Khan does a great job discussing various aspects of Bitcoin’s legality and compliance for sending money internationally in his “The Lure of Remittances for Bitcoin Startups” article. Some providers are hoping that if they are MSB-licensed outside the US, they could have an online website and provide money transfers from the US to their country – see Faisal’s response here. Finally, read his step-by-step instruction on how to make Bitcoin international money transfer compliant.

For Bitcoin regulations in USA, state-by-state, read here.

Overall, we understand why a cross-border remittance provider requires more scrutiny than a company in a lending space like Lending Club or Kabbage. The additional risk of money laundering and terrorism financing might outweigh any potential benefits. At the same time, we are concerned with applying an excessive amount of regulation to this seemingly promising innovation. While many in the bitcoin community believe that bitcoin dominance is around the corner, we have a more cautious view that bitcoin money transfers are going to remain a tiny phenomena for years to come. So when we notice how governments or banking organizations are gearing up regulations and imposing limitations (FinCEN Fines Ripple, WellsFargo shuts down Bitfinex transfers), we are worried that Bitcoin’s remarkable potential would be validated much later on because of these premature efforts. Like with crimes in a non-bitcoin space, anybody is welcome to raise a concern, but so far there seems to be more fear about what might happen rather than an objective assessment of bitcoin’s present danger (see “Bitcoin Still Confuses Bankers” for a macro view on this vector).

At the same time, Bitcoin ecosystem must massively step up its efforts to fight off criminals using this innovative technology. Too often we hear excuses about anonymity rather than seeing a proactive termination of criminal activities. Where are the cases of identifying tax evaders among its customers by Coinbase, Kraken, Bitstamp? In the case of a global Ponzi scheme by MMM, it is technologically feasible to identify and shut down accounts of the scheme participants. This massive scam is disproportionately targeting low-income consumers in Africa and South-East Asia. Governments of affected countries took urgent actions. For all the talk about caring about the poor, what has Blockchain/Bitcoin community done to stop this fraud?

Making Bitcoin money transfer a reality

There is a long-term vision for Bitcoin-based remittances: as the currency itself becomes stable in the next 10 years, there would be another wave of startups to market Bitcoin as a storage of value and investment. While those startups are also likely to burn out, they would pave the wave for a mass adoption of bitcoin. And at that point, we will finally start seeing new breed of “killer” remittance apps that take advantage of FULL Bitcoin, currency & ledger.

In a short-term, a bitcoin-based remittance providers might be better-off starting in lower-volume-higher-margins corridors that we discussed above. Outside of legal realm, there is an intriguing case for Bitcoin-based remittances as the transitional “hawala” replacement. For some top global destinations like China, informal remittance channels might be on par or higher than formal. Why senders prefer a shady route instead of “western union”? Privacy & Taxes. Based on our discussions with residents of Chinese communities around NYC, we learned that a) many of them seem to work without paying taxes, b) they also seem extremely secretive of their earnings, both for safety and reputation reasons, c) they perceive a real risk of a bank or remittance provider sharing their transfer information with authorities and/or crime syndicates in USA and China. Without commenting on legal aspects, a Bitcoin-based remittance provider, super-localized and focused on complete anonymity, might bring such “unbanked” segment into the fold of using online tools. Then, maybe some of such users would be less hesitant to try a licensed remittance provider.

There are also opportunities to showcase power of Bitcoin in war-torn countries like Somalia, Libya, Syria. Banks don’t allow remittance with such countries, so a Bitcoin provider would have no legal competition.

We are eagerly awaiting the day the first bitcoin money transfer provider could be added to SaveOnSend app, assuming it won’t be one of the existing players simply adopting parts of a bitcoin-blockchain technology. To enable such startup, we would overlook its understandably tiny market share and potentially not-the-best pricing. There are only 3 rules:

-

Licensed as a money transmitter n USA’s 10 largest states (CA, FL, TX, NY, IL..)

-

Independently verifiable 100s of happy customers, representative of a typical mass-market international money senders: monthly-quarterly transaction, $0-3K range, sending to China, India, Philippines, or Mexico

-

“Bitcoin-seamless” – customers send USD and receive destination currency, but don’t have to do something extra just because of bitcoin